Friends! Summer is here and it’s time we save as much money as possible on the every day items so we can do fun stuff with our kids. I don’t know about you, but I love it when I can save a few dollars here and a few dollars there on the small things (and the big things!) then turn around and do some fun activity with our little guy.

There are so many free summer activities you can be doing during the week and on the weekends with your little ones. In a perfect world every fun trip, activity or event would be free… BUT that’s our dream world, am I right? Sometimes, though it’s worth it to splurge a little on a fun-filled weekend. I can show you how splurging won’t really hurt and how you can plan for it even better. These money saving hacks can really add up. They don’t take too much time to do and you should probably be doing them during the non-summer months, too.

I created a quick video that shows my favorite money saving hacks and how I use them to save money for our family. You can keep reading, too.

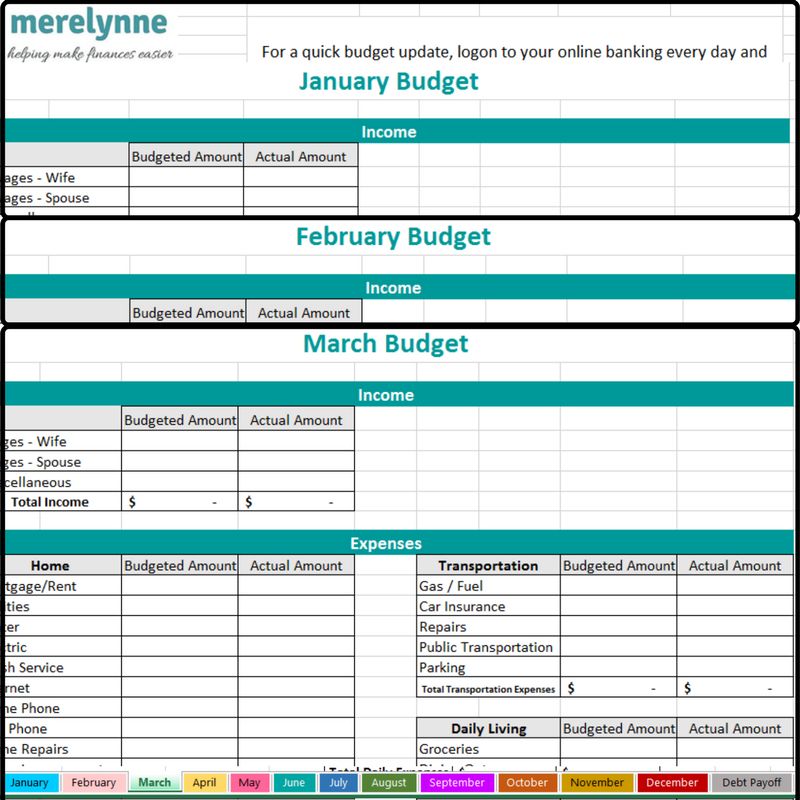

Update Your Budget Weekly

You should be checking your budget on a regular basis and if you’re looking on ways to save money then bump your look up to weekly. You should be sitting down with your spouse weekly to look at your budget, see where your money is going and where you should stop spending. My husband and I do this on Sunday afternoons while we meal plan. Sit down to look at the week ahead and create a plan. Not just a plan of what events you have or places you need to be, but a plan of how you’re going to spend your money. You and your spouse need to be on the same page, especially if one of you is the saver and the other one is the spender. Your budget doesn’t have to be complicated, all you need an agreement of how this next week is going to go.

By looking at your budget weekly you can make adjustments before it’s too late. Cook dinner at home instead of grabbing fast food. Just think for your family of 4 it probably cost $20 or more for a drive-thru dinner and if you’re doing that two times a week, every week you’re wasting over $2,000 dollars a year.

Check For Deals

If you do want to splurge or just can’t seem to find the time to cook dinner one night then check for deals. I like to keep any coupons we receive in the mail (normally called junk mail) in my car. Then if we’re running errands or (let’s be honest here) just too over cooking then you can use a coupon. Now you can keep your coupons in a binder, an accordion file or in your console. Whatever works for you. Just make sure you keep them in your car so when you’re out there is no excuse to pull out the coupons and pick a place that you can save some money. So instead of spending $20 for your family, you’re now spending $15. That $5 savings adds up to over $500 a year.

I also love paying attention to events or grand openings happening at our favorite places. In our little town we have a pretty fun water park. A few times a year they will host a business after hours or an open house. Just by attending, eating free food and mingling with friends you can score some free day passes. So simple!

I know our public library hosts free days and events all of the time during the summer. Just subscribe to local places around your town to be the first to know of free concerts, events and passes!

Money Saving Apps

Now these money saving apps don’t necessarily save you money, but you can earn money while you are grocery shopping. You can let the money you earn in these apps accumulate then use them for vacations, special outings, or even help with your Christmas budget.

Ibotta is great because they help you earn money with items you already purchasing. All you have to do is register for an Ibotta account (my referral link) then get started. I recommend checking Ibotta before finishing your grocery list so you know and can compare prices of items you already buying. But you have to be careful and make sure you look at the price. Just because the name brand item has a $0.50 rebate available it doesn’t mean it is going to be cheaper than the store-brand item. So make sure you’re aware of prices and take a few minutes to do the calculations.

Walmart Savings Catcher App is great if you do most of your shopping at Walmart; however, since Walmart stopped price matching I have found I spend less and less money there. But it’s Walmart and it’s soooo easy to just go to one store, get everything you need and be done. So I can’t say I do zero shopping there these days because then I would be telling a lie. I have found their app doesn’t count everything that is on sale in my area (because I have checked the sale ads for items I bought a few times and when my savings come in it doesn’t add up), but it’s still better than nothing.

Ebates is another tool I use when I do online shopping. You can register for an ebates (my referral link) online then just start on their page before going to the store’s site. You simply earn money for doing your day-to-day or special occasion shopping.

Sell What You Don’t Use

Look at your house and think about items you no longer use. I’m sure you could go through your hall closet, the garage, your clothes closet and even the kitchen to find stuff you aren’t using. Old toys that you’re kids have outgrown are great to sell!

I use Facebook Swap Shops for selling a lot of things that are still in good condition that we don’t use. You can utilize Facebook, Craigslist, letgo and other apps for finding buyers. Just make sure you meet in a well-lit and crowded area. I like to have people meet me at my work so I don’t have to get back out in the evening and I can control where we’re meeting so I know it’s in a good area.

Buy Used

This goes along with selling what you don’t need anymore. Take a look at those swap shops, craigslist ads, and so on for any seasonal kids’ clothes and new toys. You can find great deals on clothes. Your kid is going to outgrow those brand new summer shorts that cost $20 just as fast as he will used shorts that are in great condition that cost $5.

I like to buy seasonal clothes like shorts for our little man using Facebook swap shops. I bought these four pairs of shorts for $3 last summer. He wore these shorts all summer long! You couldn’t go into a store to buy four pairs of shorts like these for only $3 a piece let alone $3 for all of them! If your town has FB Swap Shops you can setup an alert around your certain criteria. All you have to do is enter “boys 12 month clothes” or any variation then click save. Each time someone posts a listing that meets your search, you will get a FB alert. I even do this for Winter clothes for our little guy. You could probably find some good pieces for you and your husband, too. Just keep an eye out for new listings. I prefer the ones that come from a smoke free and pet free home, but since we have three dogs the pet part isn’t a deal breaker. I of course wash all clothes before wearing them, just to be on the safe side.

Do A Spending Freeze

The final option, which is the quickest way to save some serious money is to do a spending freeze. You can do one for a five days, a week or even an entire month. I’ve explained how to do a spending freeze before, but you basically pick a time frame to spend no money. No grocery shopping, no eating out, no sitters, nothing.

There you have it, my favorite money saving hacks. Leave a comment below letting me know your favorite money saving tips!