If you could accomplish anything in 2018, what would be? For most of us our answer might involve money in some way. From having less debt, to making more money, having more saved, budget better, whatever it might be. Money is a huge focus for many of us. There never seems to be enough to go around and when it rains, it pours – am I right? This year, I want to help you save more money for those rainy days or for those days where you just want to have a little fun.

Last year, I introduced the 52 Week Savings Challenge and it was a huge hit. Our family really benefited from taking simple steps to put more money into savings. So, I wanted to start 2018 off with a bang and bring back the 52 week savings challenge.

Now remember this savings challenge is above and beyond what you’re currently budgeting for. This money either needs to come from your grocery budget, your eating out category or a combination of any budget categories. We don’t want to take away from what you’re currently putting aside for your emergency fund or your debt payments.

Last year when we decided to do this challenge, we looked at our budget and realized it wouldn’t hurt to have an extra $1,300 in the bank by the end of the year.

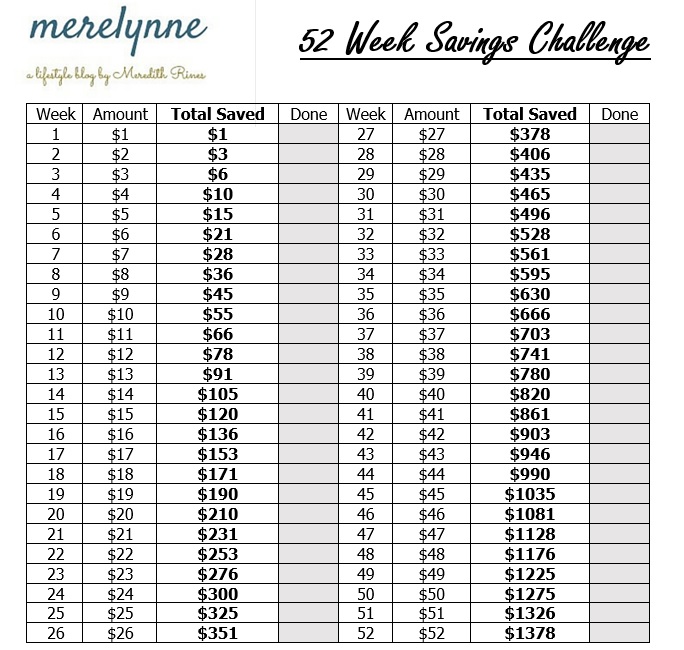

We created an easy-to-follow 52 Week Savings Challenge. It’s easy to follow and you can really tackle it any way you want.

Here’s the gist of the savings challenge:

Start off with saving $1 the first week, then add $1 every week to you new goal. Here’s what it looks like for the whole year:

week 1 – $1, total of $1

week 2 – $2, total of $3

week 3 – $3, total of $6

…

…

week 52 – $52, total of $1,378

I created an easy PDF for you to download to keep track. You can download this free printable here.

Here’s another way to tackle this 52 week savings challenge:

You can start with week 52 and work your way backwards. That way you’re starting with savings $52, $51, $50 and so on then when it’s closer to the holidays your savings would be less than $10 a week. It’s up to you.

Just decide which way is best for your family and get started.

What are you going to do with this extra savings at the end of the year? It’s going to be good to use towards Christmas gifts or you can add it to your emergency fund or even debt! Whatever you want to do with it, it’s up to you!

Just think, $1,378 can be yours by saving a few dollars each month for the next 12 months. So easy!

Need More Help?

If you’re looking for a great tool to help keep your family on budget, then check out out my budget spreadsheet. Each month is laid out right in front of you where you can keep track of what you budget and what you actually spend. Now you’ll know in real time how you’re doing each month.

Latest posts by Meredith Rines, MBA, CFP® (see all)

- How To 10X Your Productivity With This Simple Tool // Using A Red Line Graph - June 24, 2020

- Mini DIY Office Makeover [Photowall Review] - June 17, 2020

- How To Track Your Projects and Profit With Subcontractors - June 11, 2020