As children we learn most of our habits from our parents and family members. We continue developing our habits even as high schoolers. Once we’re in our late teens and early 20s, most of our habits are set. However, there are a few important ones that we need to continue working on to set us up for financial success.

Not to get too deep on you, but what you do now will help develop a path for the rest of your life. Now that we’re out of high school, we have to start acting a little bit more responsible. That means knowing where our money is going, helping others, and focusing on those in our lives instead of ourselves.

Here are my tips for the 5 financial habits you need to develop in your 20s:

Learn how to budget your money.

If you haven’t setup your budget, do it now. It doesn’t take very long and it can really show you where you stand. We all want real-time results and budgeting can you give real-time feedback. Starting a budget is the first step you should take to becoming financially successful.

Don’t live above your means.

I know sometimes it’s hard to say no, but you have to be realistic. Know what you can afford, how much play money you have and respect it. I like using the cash envelope system spending for the areas I have tendency to go a little crazy in. It keeps me on track and focused on my bigger goals.

Know your credit score.

In your 20s you should know what’s on your credit report and be working towards a good credit score. Don’t let past mistakes haunt your future. Plus, a higher credit score means you get a lower interest rate and better deals on loans. So if you’re looking at buying a new (to you) car or a house having a credit score about 700 is ideal. Make sure you check your report a few months before needing to take out a loan. If there are any errors on the report then you’ll have time to get them corrected.

Pay down debt and student loans.

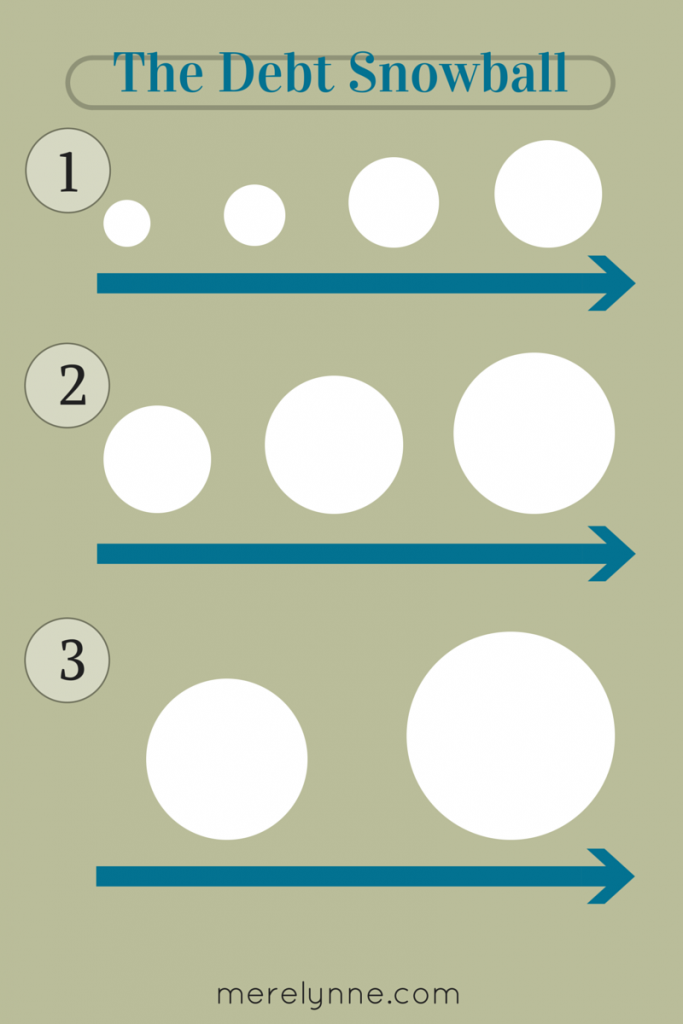

Now is the time to be paying off debt and knocking out those student loans. You can take my way of paying down debt, which is the debt snowball. You will have so much more money for saving or spending when you don’t have debt to worry about. Just think about the amount of money you spend each month on bills like credit cards, loans, etc. That money could be spent on saving for a future home, your retirement plan, or even just being able to do more.

Save for a rainy day and the long term.

I cannot preach enough about the importance of having an emergency fund. It doesn’t have to be some crazy high number when you’re starting out. I always say $1,000 is a good starting number. J and I have used our emergency fund a few times when something unexpected comes up then we simply work on replacing it.

As a couple or as a young adult you need to know what’s important to you. For us, having a solid retirement savings and building our dream home are huge. Once we pay down more debt then our next focus is saving for land and building our dream home.

I never think that J and I can’t reach our goals. I know that by creating these great financial habits now then in the years to come we won’t struggle as much. We will be able to reach any goal as long as we work together and have the same end-goal in mind. A few months ago, I created the 5 Money Management Tips you need to know. You’ll notice a few repeats, but that’s just because these tips and habits are crucial to long-term financial success.

Latest posts by Meredith Rines, MBA, CFP® (see all)

- How To 10X Your Productivity With This Simple Tool // Using A Red Line Graph - June 24, 2020

- Mini DIY Office Makeover [Photowall Review] - June 17, 2020

- How To Track Your Projects and Profit With Subcontractors - June 11, 2020