Are you looking for some easy ways to save money?

Well you’re in luck! I am putting together my best list of ideas, tips and methods that will help you save money fast. I don’t know about you, but Summer is usually a bit harder for me to save money. Maybe it’s because there are a lot of fun things you can do with your family during the warm months or maybe you have school-aged children that you’re desperate to entertain for a few hours (I know I will be there soon!). I had a realization the other night, if I made sure my budget was on track for the big stuff – groceries and eating out then that would give us a little more wiggle room for the fun fund. So I put together a list of 20 really easy and simple ways to save money.

No matter if you follow all 20 of these tips or just a few, you will find yourself saving money and being able to do more with your kids.

Cash Back Rewards

If you use a credit card then make sure it’s one that offers cash back rewards. We typically use a credit card for gas or really large purchases (our debit card has a $300 max per day). Now we can build some cash back to use on vacation, Christmas shopping or just because type fun.

Ebates

I am preached before about how much I love Ebates. I do so much shopping online – clothes, toys, diapers, wipes, dog food and more that by using Ebates I can get cashback. It’s simple. I start at Ebates.com and then click on the store I want to head to. Then I shop normally and Ebates takes care of all the rest. Then I get an email saying I earned money from my recent trip. Afterwards you can get a check in the mail for the amount credited back to you or you can link your Paypal account. If you don’t have an Ebates account yet, use my referral code to get signed up!

Money Saving Apps

Again, I have shared about how much I love apps on my smartphone that give me money back. I have to admit though, I mainly use Ibotta these days thanks to the way I shop now. I still use the Walmart Savings Catcher App, but ever since Walmart got rid of their price matching I don’t shop there nearly as much. If you live in a bigger city or have more grocery store options then some of the other savings apps I talked about in this post can really help you.

Stick to Your Grocery List

This one sounds so simple, but how m any times do you find yourself putting items in your cart that aren’t on your list. My guess is probably at least 3-5 times each shopping trip. That can really add up. You need to be strong and have a plan when you step into the grocery store. Let’s think about how much extra money you’re spending by not sticking to your list. Say you buy on average 5 items that aren’t on your list and they have an average price of $7 each. If you shop twice a month and are consistently adding 5 items to your basket then you’re spending about $900 extra each year. Seriously! That’s a mortgage payment or a huge dent on your credit card bill.

Check Deals at the Store

I am not a huge fan of shopping at multiple stores in one week just to buy my groceries. I don’t really like spending too much time at the store and for me, it’s not convenient. Especially with a 15 month old – at some point he’s so over getting in and out of the car. However, I am a fan of deals. If there is a deal that it’s just too good to pass up then I buy it. And I might even buy extra to freeze or put up for later. You have to know what works for you and your family. If it’s easy for you to shop at multiple stores then do it! You can save money by doing that way. However, if you’re like me and just find grocery stores to be super annoying then just keep an eye out for the killer deals to buy.

Loyalty Cards

Most stores have loyalty cards or rewards cards they offer. The cards are typically free and give you some sort of point for each dollar you spend. I have one for a few grocery stores I shop at and even one for my gas station I frequent. Once we spend so much then we get free sodas and food, which is awesome when you’re craving a fountain diet mountain dew after a long weekend.

Pay Less for Gas for Your Car

Speaking about gas, have you heard of Gas Buddy. It’s a free app you can download then search your area for cheap gas prices. We use it a lot when we’re traveling to make sure we’re getting the best deals on gas.

Take Your Lunch To Work

If you typically eat out during the week then try bringing your lunch a few days. The savings can really add up. For instance, you eat out 5 days a week and spend about $8 for food. That’s $40 a week and if you do that all year long you’re spending over $2,000 a year on lunch. Let’s face it though, $8 is being conservative. Most lunch places cost on average $10-$15 per person if you include a drink, tax and tip. By taking your lunch to work just three days a week then you could be saving over $1,200 a year in eating out costs.

Eat Leftovers One Night A Week

In our home we tend to eat leftovers at least once a week, sometimes twice. This way no food goes to waste and we can clean out our fridge. If you have small children around then you might do this more often, because once you find a food your kid likes you keep feeding it to them night after night. We made some chicken and rice the other night, our little guy loved it so for three nights we ate it because we knew he would eat it. Yep! It’s also a huge money saver because you don’t have to spend more at the grocery store and one night a week your meal plan is already done for you.

Eat At Home More

This kind of goes with eating leftovers, but you can really save some money by cutting your eating out budget. Typically during the summer we cut our eating out budget by over half. That way we spend more time at home either cooking in the kitchen or grilling outside. Think about how much it costs your family to eat out, we’re not talking about a fast food place or even a nice sit down restaurant. But something in between. For our family of three that can easily cost around $35-$45 dollars per meal. If you’re eating out twice a week then that can really sky rocket.

Install a Programmable Thermostat

Have you seen those thermostats you can control with your smartphone? I love them! You can totally program them to save you money. When you’re home, it knows and starts cooling (or heating) for you. Then you can set it to kick off or not run as much when you’re not home. It’s a total game changer when it comes to utility costs.

Wash Laundry in Cold Water

Most washing machines and detergents these days work just as good in cold water as they do in hot. So for us, we wash everything on cold. It saves money because our hot water heater isn’t having to work overtime and the electricity it uses is cut proportionally. I would recommend buying better laundry detergent (generic is fine still) to make sure you’re getting a good clean though. I even put together these free dryer balls that have been a huger saver for our family.

Start Working Out

This one might seem a little off, but trust me on it. People that work out and stay healthy are less likely to get sick. When you get sick you (should) visit the doctor, which means you have a copay, prescriptions to fill and maybe time off work. So by taking the time to work out, even if it’s just going for a nightly walk then you will be better off for it… and so will your wallet!

Start a Vegetable Garden

Growing your own vegetables is a great source of saving money. Produce can be expensive at the grocery store, plus you never know exactly what pesticides they use on the product. So by growing your own you can control what is being out on the food and you don’t have to pay the large store mark up prices.

Buy Generic When Possible

If you pay attention to most generic brand items they are usually made with the same ingredients as name brand. Sometimes name brand factories even make the generic items themselves! Crazy, I know! When our little guy was on formula our doctor mentioned how it has to go through so much testing that when it comes down to it most formulas are the same. You need to find one that agrees with your little one’s stomach, but honestly there isn’t one that’s on the market that isn’t safe. So I use that same philosophy with most of the items we purchase. If I can find a generic brand for less then I am going to give it a try.

Shop Around

Did you get multiple quotes on your auto insurance, homeowners insurance or life insurance? Maybe, but probably not. You might have just went with the guy down the street or used the same guy your parents’ used forever (I was guilty of this one!). You should take a few minutes to call around and compare prices. You could be paying a lot more for the same type of coverage as what someone else offers. Make sure though when you’re comparing quotes, you’re comparing the same coverage. Check to make sure you’re asking about the same liability, medical and personal property coverage amounts.

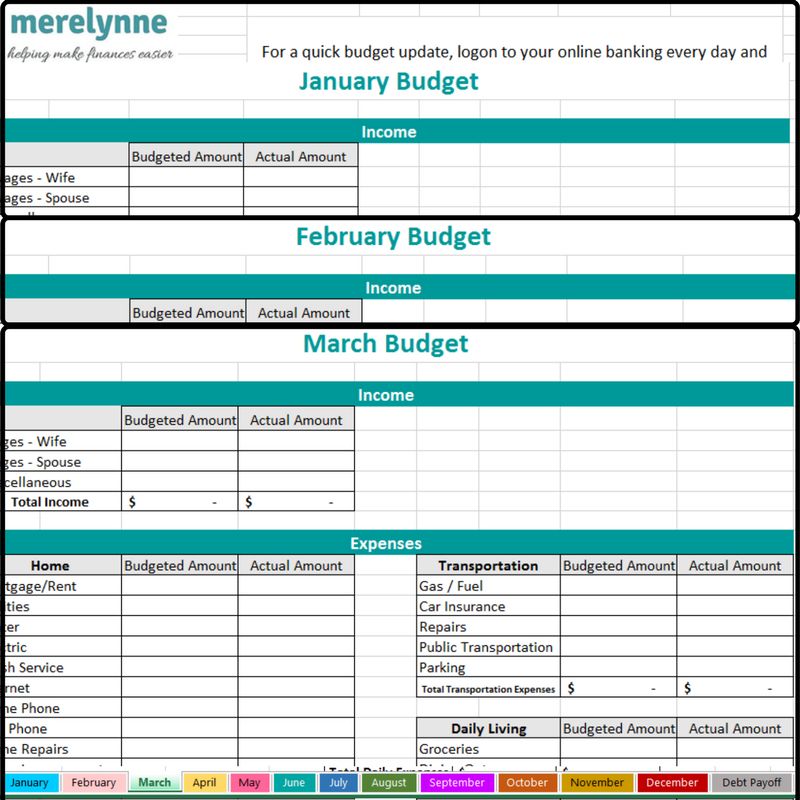

Stay On Budget

I know this one seems easy, but we all know it’s not. Sticking to your budget can be difficult, but it can be so helpful. I created a budget spreadsheet that has helped my family and others know exactly what’s left in their categories so they stop overspending. I highly, highly recommend using a budget spreadsheet or some technique of saying here’s how much I have to spend and here’s what I’ve already spent. That way you know without a doubt what you have left before your next pay period. It can help you from overspending, which can help you save money.

Keep Track of What You Spend

This goes along with keeping a budget, but doesn’t have to be too sophisticated. It’s important to know where you’re money is going that way you don’t spend too much and you can make sure you have enough to cover the important areas – like rent, groceries and car payments. I recently shared my favorite technique for tacking what you spend. All it uses is an envelope and a pen – it’s simple and effective.

Set Priorities

You need to know what’s important to you and your family. This is where money dates come in really handy because you’re able to talk it out with your spouse. Finding out what’s a priority will help keep you focused to reach your goals. Your priorities can change too, so talking about them regularly and reevaluating them is key.

Find Free Activities To Do

No matter what time of year it is, you can always find free stuff to do with your family. Check out my post for free summer activities and free fall activities. In all honesty, you just need to keep your eyes open to advertising and special deals. Most places have days where they don’t charge admittance, which is awesome. Find a few places your family loves and follow them on Facebook. Then you can check their page for any free days or special deals they have running.

What are some of your favorite ways to save money? Leave a comment sharing your tip!

Need More Help?

If you’re looking for a great tool to help keep your family on budget, then check out out my budget spreadsheet. Each month is laid out right in front of you where you can keep track of what you budget and what you actually spend. Now you’ll know in real time how you’re doing each month.