Alright y’all, I’m finally breaking down and committing to a spending freeze. I realized a quick little no spend week would be just what the budget doctor ordered. I wanted to go over exactly how to do a spending freeze, what a spending freeze is and what I’m hoping to accomplish.

Check out the quick video below for more details and tips on doing your first spending freeze.

What is a spending freeze?

It’s exactly as it sounds. For the a specific period of time you do not spend any money. None. Absolutely no money, unless there is an emergency. What that means is you have to get creative and use what you have on hand for the next week to feed your family and entertain them.

Why do a spending freeze?

Committing to not spending any money will help reset your thought process. You will be forced to tell yourself no on those impulse purchases and those easy-to-fall-into dinners where you grab fast food or take out on the way home. Think about the amount of money you and your family spend each week between lunches out, dinners, movie rentals, the gas station sodas, and so on. For our family three that could be upwards f $100 a week. ONE HUNDRED DOLLARS A WEEK! Crazy!

A spending freeze is a great way to zero back in on your budget. Get your spending in check.

If you add up how much money you can save by doing a spending freeze then think about what you could do with that money. For us it would be paying a little extra towards a debt, putting the money aside for a future trip or just having a great time the next weekend we want to have some fun. You can do whatever you want with the savings! Sky is the limit!

Just think if you commit to do a spending freeze every other month and save about $100 that would be $600 for the year. You could use that money on a nice little family getaway or even on Christmas for the family. If you have a larger family or really like takeout you could be saving close to $300 or more by committing to a spending freeze for just 7 days.

What are the rules to a spending freeze?

Simple. Do not spend money during the spending freeze.

- Check your pantry and fridge now to make sure you have the essentials before we start on Monday.

- Fill the car up with gas to make it through.

- Can you use gift cards that you have? Yes, of course. If you have a gift card to a restaurant then go ahead and use it. But make sure yo realize a spending freeze includes tip and tax. So if you have to dig in your pocket for a tip then save it for later.

- Go back to spending normally the week after the freeze. Don’t think you have to go out the week after it ends and buy twice as many groceries. The point is to use what you have on hand and then continue as business as usual.

- Utilities and emergencies don’t count. I do not suggest to you or to anyone not to pay your bills during this week. If you typically pay your utility bill or cell phone bill this next week then please go ahead and take care of those. Make sure you’re not skipping any bill payments, debts or loans amounts during this next week. The same is true for any emergencies you may come across. If your little one gets sick and you need to take them to the doctor knowing there will be a $20 copay then please pay the copay.

What doesn’t constitute an emergency?

Going out to eat because you’re too tired to cook.

Buying that new shirt because it’s on sale.

Digging for change to get your gas station fountain diet mountain dew fix.

Treating the office to donuts on Friday morning because you’ve had a hard week.

Getting a sitter so you and the hubs can enjoy a night out using gift cards. (Now if you can swap those services with a friend where she watches your little one and next week you watch hers then go for it!)

How long does a spending freeze last?

It can last as long as you want. I recommend a week. It’s simple and quick. You can do just about anything that lasts a week, right? The longer you make it then the more likely it is you will not be successful. I’m wanting to start your family and my family off on the best foot possible. So just keep it short and sweet. If you want to do 5 days then do 5 days. It’s up to you.

When does the spending freeze start?

We’re starting on Monday and going for 7 full days. Take the weekend to do some meal planning by checking what you already have on hand, look at your milk and bread and fill your car up with gas. I like to pack J’s lunches and I usually eat the night before’s leftovers. So I am going to make sure we have enough lunch meat to get us through and then will just to make sure to cook a little extra at night for my lunch. I’m not going to go out and buy more lunch meat if I don’t have enough, but I will get creative – tuna, canned chicken, chicken wraps, etc. Whatever I can do to stretch what we already have.

Alright, let’s do this! Happy spending freeze friends! Check in over Instagram this week for more ideas and tips during our spending freeze.

Need More Help?

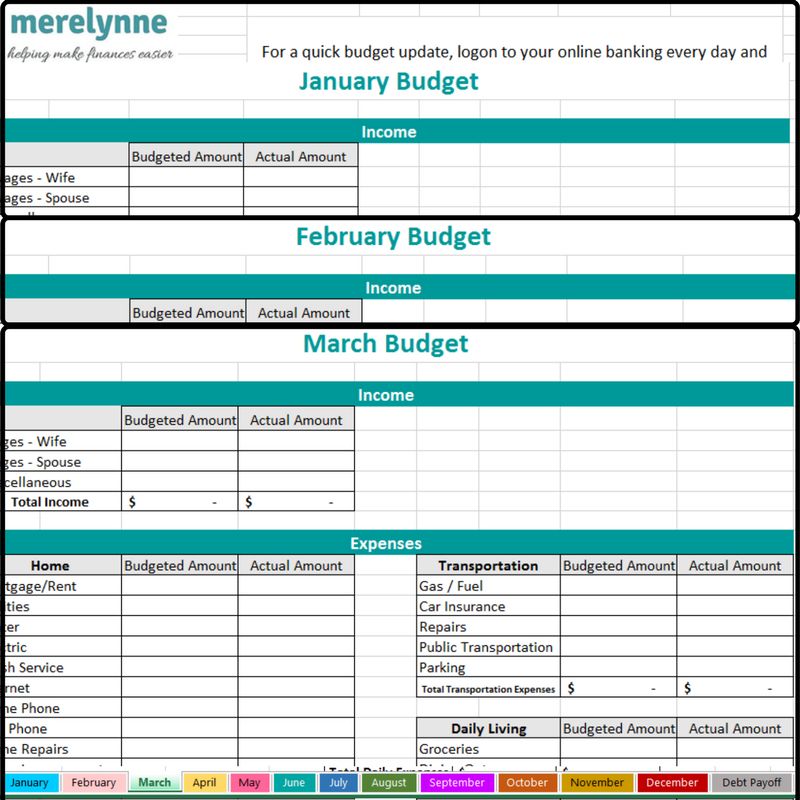

If you’re looking for a great tool to help keep your family on budget, then check out out my budget spreadsheet. Each month is laid out right in front of you where you can keep track of what you budget and what you actually spend. Now you’ll know in real time how you’re doing each month.