February’s Focus on Finances is done!

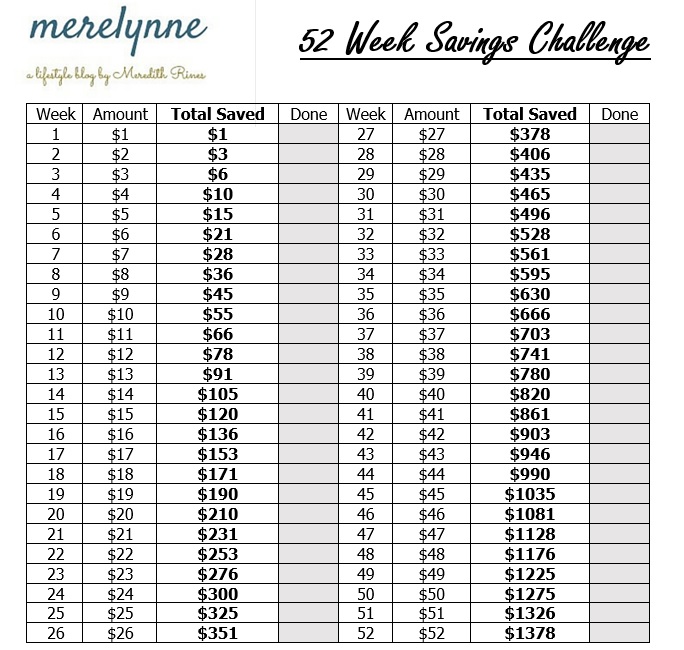

How did you do last month? Did you hit your goal of increasing your emergency fund or making a dent in your debt? I set a pretty lofty goal for our money and I knew it would be hard to hit it. But I made a serious dent in reaching it. It won’t be long before we have $3,000 in our emergency fund.

Why did I want $3,000?

Well each of our health insurance deductibles is $1,000. Since there is three of us in the family I wanted $3,000 in the bank. You never know what will happen and having that amount would be a weight off of our shoulders.

What did you focus on to increase your money?

We planned our meals for the entire month. It was hard to not give into temptation, but if we didn’t have eating out in the plan that week then we stuck with it. I was able to create some new recipes that we really loved.

We also sold quite a few things on our area’s Facebook Swap Shops. That money went straight into the savings account at the bank. Whatever I didn’t sell I ended up donating at the end of the month to our local Rescue Mission.

Now that you have spent the past 28 days really focusing on your money and what areas you need to improve, it’s time to stick with it. I understand it may be hard to stay so strict, but don’t relax all of the way. Keep working with the cash envelope method. It can help you stop overspending. We use an easier cash method that I’ve talked about before.

Leave me a comment letting me know one thing that really helped you through February’s Focus on Finances. I’d love to know!