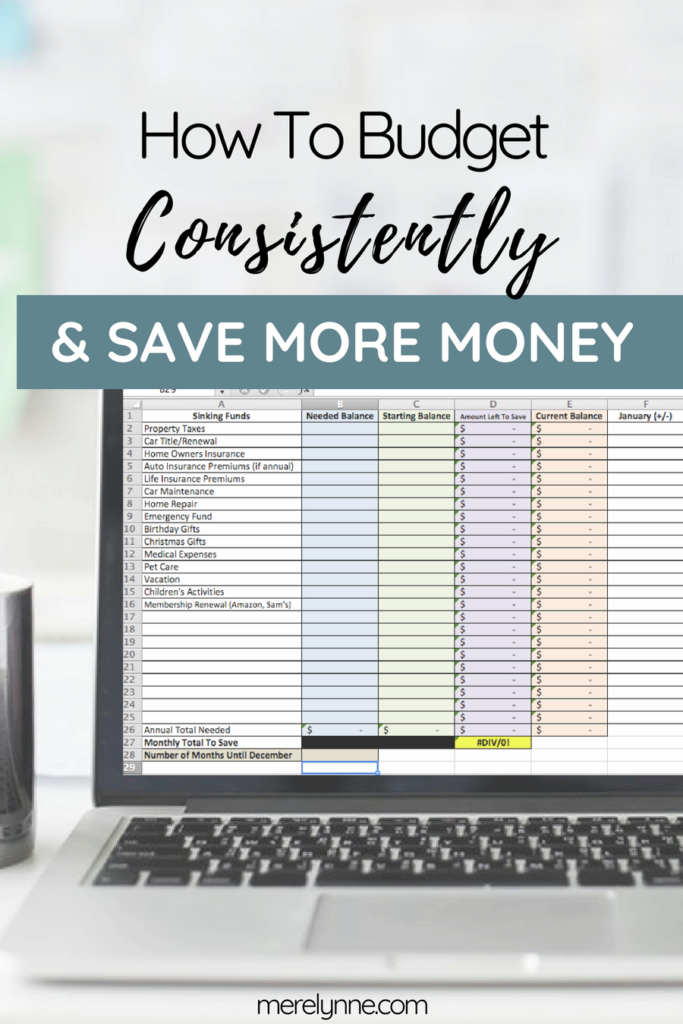

Are you tired of failing at your budget month-after-month?

I hear ya!

It can be a struggle to stay on top of your budget with life happening around us. That’s why I’m on a mission to show other Moms just how easy budgeting can be if you remember a few key things:

- Why you started in the first place

- Your end goals

Once you know those two key points – then the rest is a breeze. Well… I wouldn’t say a breeze, but it becomes a lot easier with time.

Every once in awhile though we all make mistakes – we overspend there, we forget to track there and next thing you know it’s been months since we’ve even opened our budget template. It happens, but I’m here to tell you that it doens’t have to be this way. We can make mistakes and we can mess up, but we need to be focused on our two most important things (see number one and number two above).

In today’s video I’m sharing with you five ways to instantly fix your budget so you can get back on track and keep making progress towards your goals. Check out the video down below or online:

STEP ONE: Determine where you went over. Which area of your budget did you overspend in?

STEP TWO: Figure out if it was an isolated incident or if it’s a recurring problem. Did you have to replace a flat tire this month or are you continually going over on your groceries each month.

STEP THREE: Revisit your goals on a regular basis to make sure they are still want you want.

STEP FOUR: Make sure you’re checking in on a monthly or weekly basis so you can catch any overages as they happen.

STEP FIVE: Get with your partner and make sure you’re both on the same page.

Make sure to watch today’s video for more in-depth details on each step.