Want to know the topic surrounding some of my most asked questions? Yep, you can probably tell from the title of this post that it’s…

Sinking Funds

No joke. I get asked weekly what categories should you be saving for, how much should you be putting aside, how to keep them all straight, and what to do when you need them.

I think sinking funds are a win-win for any budget. I even have a whole post dedicated to teaching you what a sinking fund is. I think they are vital to a healthy budget and can really help pull you out of a downward spiral.

One of the more recent questions I have been receiving is about how to organize your sinking funds.

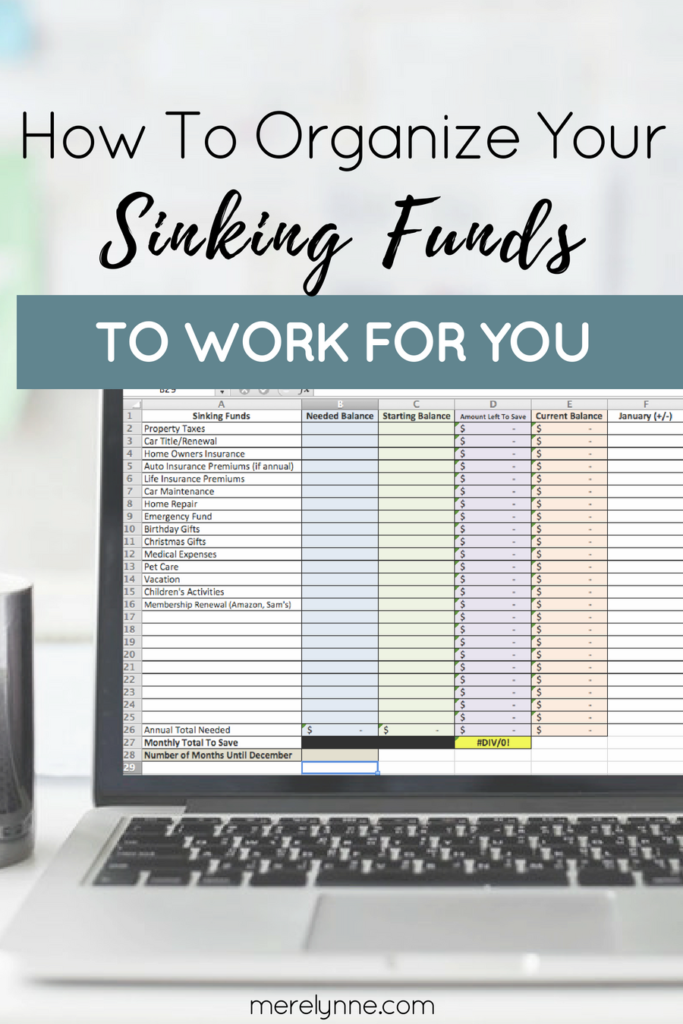

Basically, you have a list of sinking funds you need to be saving towards. You know about how much you should be putting aside each month for them (simply go back through last year’s budget or spending to see how much you spent and find a monthly average). But what you are confused about is organizing them so when you look at your bank statement you know how much is earmarked for which category.

I get it! It can be hard to remember what last month’s $200 transfer into your savings account was actually for – car maintenance or vacation?

That’s why you need an organization system that works for you and that’s easy to keep up with. To keep things simple I have one savings account at our local bank nicknamed “Sinking Funds.” That way all the money gets pulled into the same savings. Of course you could open a separate savings account for each fund, but that might be a little painful and overwhelming. So I suggest having one savings account specifically for your sinking funds and then keep track of your amounts outside the bank.

There are several ways to keep track of your sinking funds. First you can have a spreadsheet in your budget planner, which we did for a while. But we tend to pull quite a bit each month from different categories and it got hard to keep up with. Next you can keep a basic Excel spreadsheet on your computer. It works, but there are so many details you could be missing by doing it that way.

That’s why I prefer to use our sinking funds spreadsheet. It keeps me organized on how much we need to be saving each month to reach all of our goals and it helps me allocate transfers to specific fund categories. I’m able to input how much I am transfer into my savings account and then I can easily tell how much is earmarked for all my different categories.

Now when I need to pull money out for car repair, pet bills, or vacations then I know: A) How much is in each category so I’m not overspending and B) What is left after I transfer the money.

Let’s say I need to get a new set of tires for my car that will cost me $250 (I feel that’s pretty low, but you get the idea). However, I only have $200 in my car maintenance fund. Then that means I need to either pull $50 out of my checking account or borrow from another sinking fund. More than likely I’m going to borrow from another category to help cover the costs (now you could borrow from your emergency fund, but I hate to do that for something that isn’t a true emergency – most of us know that our tires will need to be replaced and try to be prepared for it.).

In the spreadsheet I subtract $200 from my car maintenance category and then I subtract $50 from somewhere else, let’s say vacation. Now my car maintenance fund balance is $0 and my vacation fund balance is $50 less. No more guessing where the money came from and how much I should have left. It’s right there, on the screen and it’s automatically calculated for me.

What else is nice about having a sinking funds spreadsheet is it will help me stay on track to reach my goals. I put extra money in each month or take out some then I can recalculate how much I should be saving, which means I know exactly where to put my money and allocate to hit my sinking funds goals.

If you’re ready to take control of your sinking funds and stop the chaos then join me. I’m launching (again) my Sinking Funds Spreadsheet out into the world. I did this earlier this year and received amazing feedback from so many of you. So I thought it was time to share it again. Right now you can grab your Sinking Funds Spreadsheet for 25% off using the code SINKING at checkout. Now there’s a catch though, this discount is only good for a limited time.

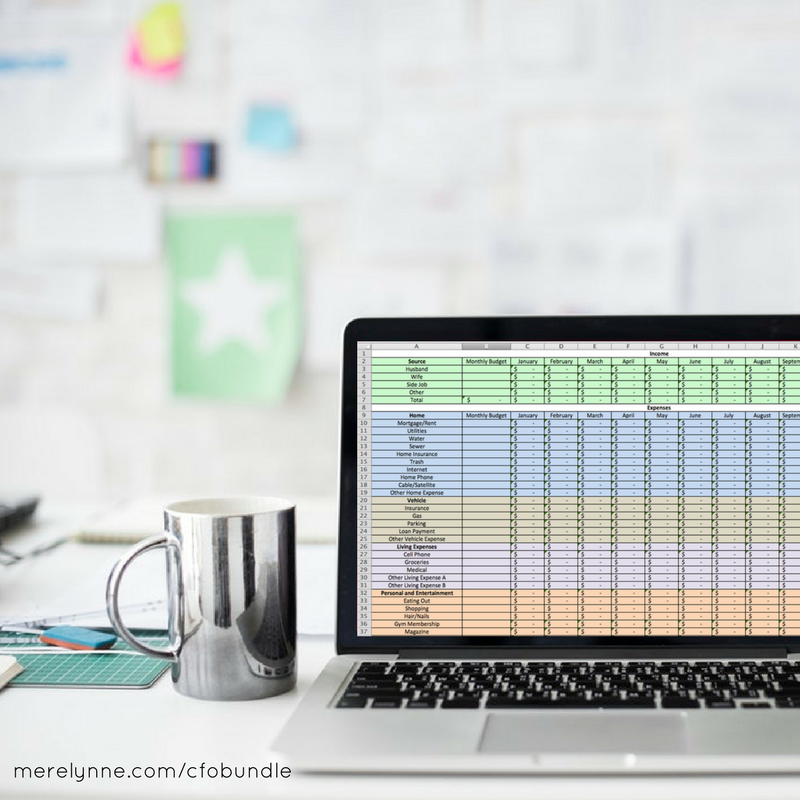

Need more help with your budgeting? No problem. You can easily download the CFO Bundle template to help you keep track of all. the. things. I know budgeting can be overwhelming. Inside the Chief Financial Officer Bundle you’ll able to set a budget for the entire year in a few easy steps. Plus, you’ll be able to track your spending in such a way that the spreadsheet will automatically calculate your totals for you. A bonus piece? The Sinking Funds Spreadsheet is included inside for FREE. That’s right! So get started right now.