Today’s post is a little different than most you’ll see on the blog. Instead of sharing tips and money help, I’m going to tell you a little story. A story about how our family got into over $70,000 worth of debt without realizing it. You see, it’s so easy to spend money. To open a new credit card. To qualify for that new car loan. Before long you have a car that has more debt than it’s worth and a credit card that’s charging you monthly interest more than your minimum payment.

You don’t see a way out. It’s a vicious cycle that keeps repeating itself.

Well one day, we weren’t able to get everything we needed at the grocery store because we didn’t have enough in our bank account and our credit card would work. It was heartbreaking and a huge light bulb moment for us.

We needed more money.

But how?

We had decent jobs, were making good money and we thought we were living below our means. But we were so WRONG.

You can watch our debt story online or down below. Keep reading for more.

We sat down and created a budget. I remember I grabbed an old clipboard and a piece of copy paper, we sat down on my great grandmother’s flowered couch we were given and got to work.

We listed out our income – I vividly remember having to log in to our bank statement to see how much we were making. We had no clue. Our checks were directly deposited each week, so we never bothered to actually look at the stubs. We knew a good guess, but it wasn’t exact and we guessed higher than it actually was.

We jotted down our expenses – again having to look at our online banking to know. We added up our grocery trips, which we made a lot back in those days. Need bread for dinner? Stop after work. Ran out of soda? That’s okay, we can grab some while we’re out.

When we started adding up our eating out totals, that’s when reality set in. That’s where our money was going. We were wasting it and on what?

It was shameful.

After we created our first list of income and expenses, we just stared at it. There we were – 20 something year olds and we were in shock. We had no clue what we made, what we spent and where our money went. But here it was in black and white.

We then sat down the next night, because the first night was a doozy to create a new budget. We talked out every expense – how much should we be spending on groceries each month, what about eating out, why is our cell phone bill so high? All of these questions we had to answer and we had to do it ourselves.

That next week I spent the better part of a day calling companies to see about lowering bills, turning features off and researching lower cost options. We switched car insurance providers, removed some fancy features from our cable lineup and set hard budgets for eating out and groceries. We also decided to start using cash instead of our debit card and credit card. It was a hard transition at first and we used our debit card a few times as a safety net.

But after a few months we started to see progress. We were actually able to get everything we needed at the store. We cherished our date nights out or dinner with friends because we didn’t do it all the time anymore.

The first time we were able to send MORE than the minimum payment to the credit card company was a great feeling. We knew we found something that worked.

Each week we would sit down together, on that old couch, and update our budget. We made sure we weren’t going over and we checked to see what else still needed to be paid. We stopped paying bills late because we created a bill tracker to help us. We kept it on the clipboard we used that first night. It became the budget clipboard. Our budget was printed out each month and placed on the clipboard that sat next to our fridge. We also kept our tracker, our debt payoff letters, and debt thermometer on there, too.

The first time we received a letter stating a debt was paid in full, was amazing. We were so excited. I wanted to frame it and actually looked around our house for a frame, but couldn’t find one – I knew going to the store to buy one would be defeating the purpose. So I put it on the fridge. Then another one came and another one. Finally we started keeping them with our budget spreadsheets so we could see them every time we sat down to update it.

It’s been over four years since we started tackling our debt. We aren’t done yet, but we are close. We have two school loans left and my car. Our plan is to have my car paid off when J gets out of school next spring. Then we will be focusing on our school loans and saving for our dream home.

Each month I share a recap of our budget from the previous month. You can check out last month’s here and see our current debt payoff totals.

Having a budget has helped us more than just paying off debt. It’s given us financial confidence. J has been able to go back to school full-time, which means we’re down to just my income. And it’s okay. We’re doing great. We’re still able to live the lifestyle we were living before he quit. Sure we aren’t able to put as much into savings or put towards our school loans, but we’re still making progress. Before he left his job and started school, we did a few things:

We built our emergency fund

We saved enough for our insurance deductibles

We paid off all other debts except for my car and our school loan

We sold J’s truck and bought a small car to save on gas (he drives close to 3 hours a day, 5 days a week to get to class)

Need More Help?

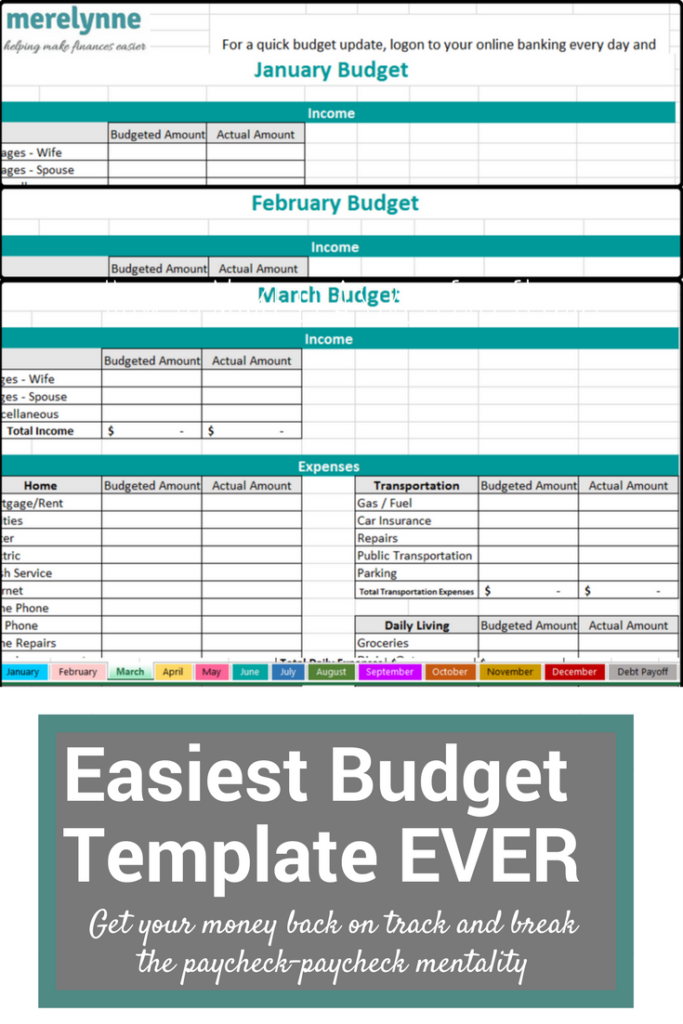

If you’re looking for a great tool to help keep your family on budget, then check out out my budget spreadsheet. Each month is laid out right in front of you where you can keep track of what you budget and what you actually spend. Now you’ll know in real time how you’re doing each month.