It’s no lie that finding someone, dating them, and then planning a wedding with them can be a bit difficult at times. Combining two ways of doing just about everything to create one unified way can be frustrating and asks for a lot of compromise from both people. That is the same for when you are asking two people with separate incomes, separate budgets, separate bills, separate bank accounts (wow! that’s a lot of separation) to come together to make a single family unit.

A team approach is the best. You have to realize that the debts are no longer his and hers, they are now yours. You have to plan to payoff the debts together and in a way that works best for the family unit.

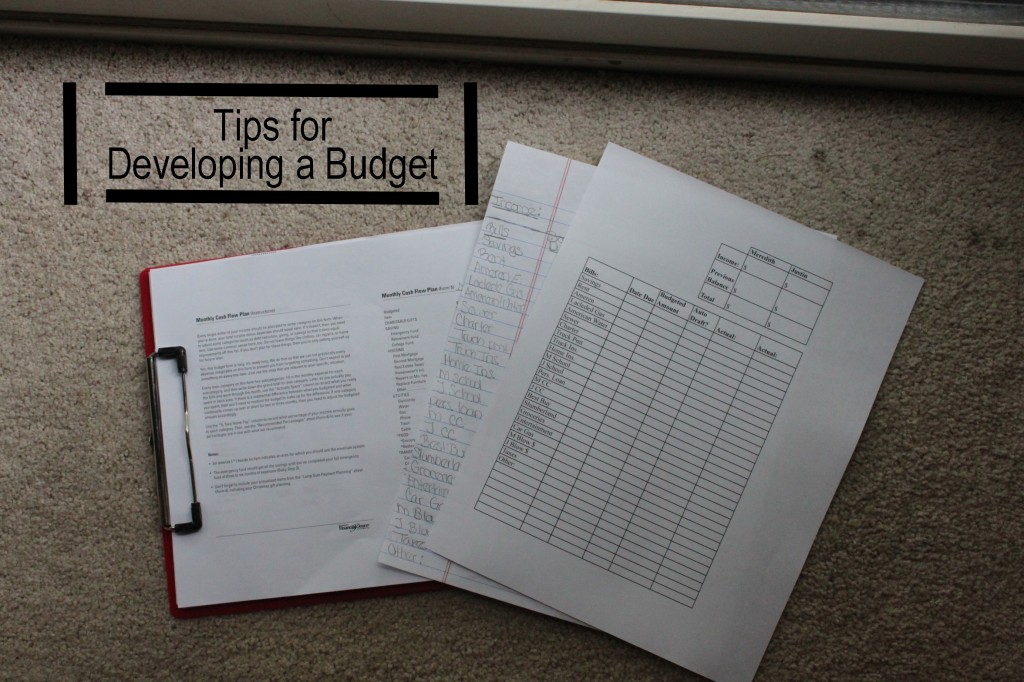

Developing a budget is key. As Dave Ramsey (roughly) says “You have to spend every dollar on paper before you actually spend it.” That means calculating both incomes, all payment of bills, and putting aside some to savings.

As you might guess, J and I have been taking Financial Peace University. While we aren’t finished with the classes yet, we are making progress. Recently, we sat down to make a new budget that worked for us. We kept finding reasons to not commit to a budget, but then we weren’t getting anywhere. Here were our excuses reasons:

1) we just moved and had a lot of unusual spending – such as our final bills for our old utilities, moving truck, extra gas for driving further than normal, etc…

2) weren’t sure what J’s new monthly income after taxes and 401(k) draws was going to be

3) I switched to salary with my job and again, we weren’t sure what my monthly net income would be.

See, reasons.

We were tired of reasons and it was time to get started. I took Dave Ramsey’s forms and made a basic template using our monthly bills that we can hang on our fridge to talk about when monthly bills come in and get paid.

Cheers!

Latest posts by Meredith Rines, MBA, CFP® (see all)

- How To 10X Your Productivity With This Simple Tool // Using A Red Line Graph - June 24, 2020

- Mini DIY Office Makeover [Photowall Review] - June 17, 2020

- How To Track Your Projects and Profit With Subcontractors - June 11, 2020

This is really cool budget controlling Ideas and I would love to have them followed to save some bucks for the future.

Thanks! They have really been working for us. Good luck!