Are you tired of struggling with your budget? Having no clue where to start, what categories to use or how much you should be spending? Well I was! It was a monthly struggle creating a budget that would actually work for our family. One that told me if I was overspending or (even better) letting me know if I had extra money left over.

After years of tweaking and perfecting the budget template our family uses, I have it ready for you. This is going to be the easiest budget template you’ve ever seen. Once you know what a budget is and why you need one then it’s time to actually put pen to paper (or fingers to keyboard) to create one that will work for your family.

You can now start paying down debt, saving your money and building the foundation for the life you want. Each month when the money would run out, you probably felt like you messed up big (maybe even failed), but you didn’t!

You did not fail!

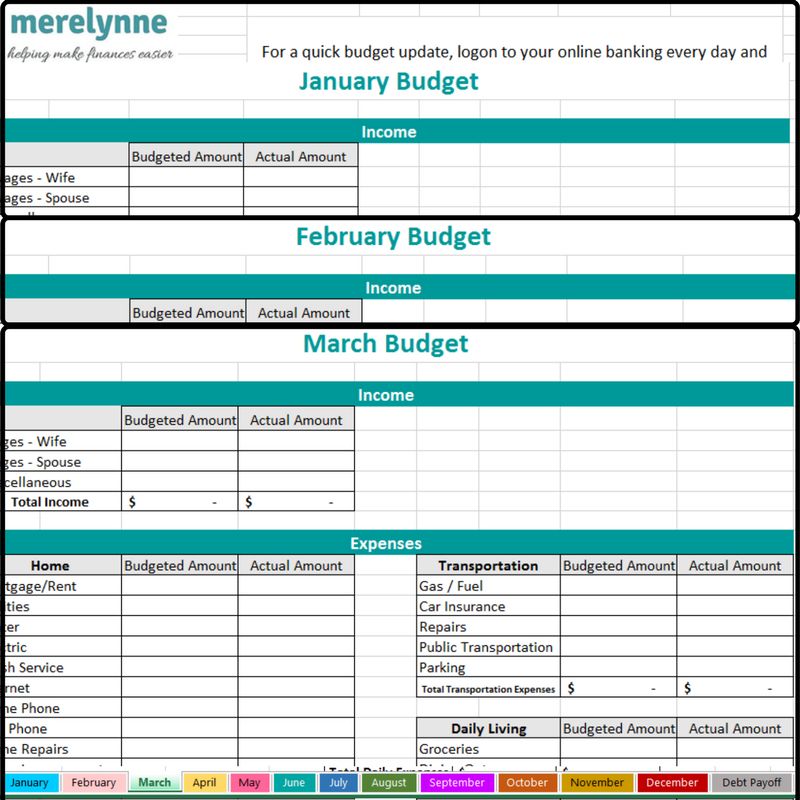

You just need a system that will actually work for you, not against you. The budget spreadsheet is the easiest tool you will ever use. You simply enter in the amount you WANT TO SPEND and then the AMOUNT YOU ACTUALLY SPEND. The biggest piece of this budget is you can update it on a daily, weekly or monthly basis. The more you update your budget then the more you will be able to have control over your spending.

You will be able to see right away if you’re getting close to the amount you wanted to spend for the month and if so, you can quickly adjust.

One of the biggest questions I see is from people not knowing how to setup their budget. Honestly it can be overwhelming to get it started, that’s why I’m taking the guess work out for you.

This simple budget template is setup for a year and it has the categories already entered. The expense categories are listed are home, transportation, daily living, health, personal, entertainment, dues/subscriptions, financial/retirement, and miscellaneous. It’s perfect for you to know where each expense goes and it makes it easier for you to accurately track your spending.

I created a quick video to show you just how this budget spreadsheet works, what you can expect from it and what the goal of budgeting is.

What if I don’t use that category?

You can simply skip over it or change the wording to fit you better. This budget template is totally flexible! This is a template, so you can customize the categories and the amounts to what fits your family.

How much should I be spending each month?

Well each family is different. Your family’s needs are going to be different than another’s. So while I can’t tell you specific numbers, you should be able to come in close by looking over your monthly bills. Of course you could probably switch internet providers or cable providers for a lower rate, but you may not want to. I recommend entering in your anticipated income first then your fixed monthly expenses. Fixed expenses are the one that don’t change from month-to-month. Such as phone, internet, cable, mortgage, car insurance, etc.

The first thing you should do after paying your fixed expenses is put money into your emergency fund and retirement accounts. Go ahead and enter that in next. After you’ve entered your fixed expenses, start looking at how much money you have left. That is your flexible spending. A rule of thumb on your grocery budget is to spend $100 per person in your family. So if you have you, your spouse and two children then you would budget $400 a month. This goes for no matter the age of your children – newborn on up. This amount includes paper products for your family, too.

You should then look at your bank statements to get an idea of how much your spending on gas each month. More than likely this won’t change, unless you took an out of town trip that isn’t the norm. You may have to look at a few months to get an average.

Afterwards any money left over needs to be spent on paying down debt. Eating out is a luxury, in my opinion. It doesn’t mean my family doesn’t eat out, but it should be the last category you budget for. Because if you don’t have any money left then you need to know before swinging through the fast food drive-thru on your way home.

What’s great about this budget template is the columns will automatically add for you. So you don’t have to guess on how you’re doing. You will see right there on the computer screen.

This budget template will only cost you $9 and you will instantly receive an Excel document. Once you have the Excel file opened you can start entering in your budgeted spending amounts and tracking your actual spending. No more guessing whether or not you will have enough money at the end of the week.

You’ll finally be able to start paying down debt, save for anything you want, and build the life you want.

If you’re looking for additional budget templates, planners and downloads then check out the shop. There are great budgeting tools and organizational planners to get your money and life on track.

Latest posts by Meredith Rines, MBA, CFP® (see all)

- How To 10X Your Productivity With This Simple Tool // Using A Red Line Graph - June 24, 2020

- Mini DIY Office Makeover [Photowall Review] - June 17, 2020

- How To Track Your Projects and Profit With Subcontractors - June 11, 2020