I have a thing for budgets and paying down debt. So it should come as no surprise that I want to keep track of any ‘extra’ income that we come across. When I say extra I’m talking about birthday money, work bonuses, second jobs (if we get them), etc. I’d like to know how much more money J and I can earn if we bust our butts a little.

I carry a journal with me at all times. You never know when an idea will strike or a grocery list needs to be written down or when you’re going to need a piece of paper. So I carry one that I got as a gift years ago. I always have about 5 journals laying around not being used. So I just use one until I break it or run out of paper then I swap it out for a new one.

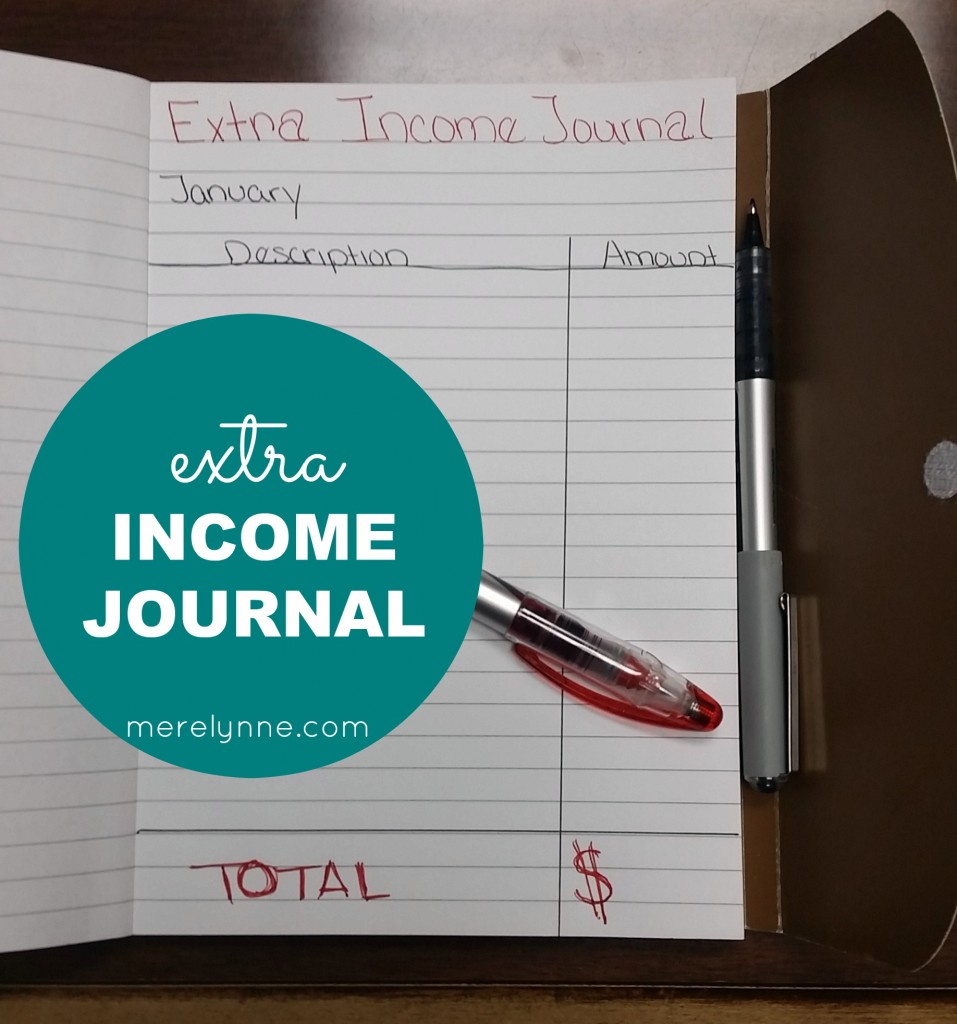

The extra income journal is not hard to create. Simply make a page for each month then make a column for a description of what the income is for and a second column for the net amount. I try to be detailed in the description section. That way I know who earned the money and where it’s coming from. That way I know if it was a gift (we had a few Christmas gifts that we didn’t get until after the new year), bonus from work or a side job income. Sometimes J helps around the office and the office manager pays him for his time.

At the bottom I created a row for the total amount for that month. I figured if there’s a month that I run out of room then I can just flip that page over and keep counting. It’s going to be really nice at the end of the year to see how much extra money we actually made and how we made it.

You could probably write create a page in Excel or Word, but I like the act of writing out the amount. It makes it more valid for me. It’s the same idea of crossing items off the to-do list. It’s done, it’s mine and there’s no taking it back.

Do you keep track of your extra income each month? How do you track it?

I’m linking up this week:

Latest posts by Meredith Rines, MBA, CFP® (see all)

- How To 10X Your Productivity With This Simple Tool // Using A Red Line Graph - June 24, 2020

- Mini DIY Office Makeover [Photowall Review] - June 17, 2020

- How To Track Your Projects and Profit With Subcontractors - June 11, 2020