Well February is done, which means our financially focused is over. Well not really over. Can being focused on your financial well-being really be done? Probably not and shouldn’t be.

But let’s recap how we did for the February challenge.

We started preparing for the baby by already budgeting as if he is here. That was a huge one for us. By taking a goal or a life event that you know is coming up and adding it into your budget then you’re a step ahead. We decided early on that we didn’t want to be surprised by how expensive the baby will be. I mean, let’s be honest – I know we aren’t budgeting enough, but as first-time parents we just have no idea what’s enough or not. So we’re doing the best we can. We budgeted for extra grocery expense to cover diapers and factored in the cost of daycare. One thing we didn’t budget in until now was the cost of adding him to our insurance. Both J and I are lucky because our employers cover most of our health insurance costs, but the baby will be a different story. We compared the plans between employers and are now saving that amount, too.

We setup an extra savings goal of $300 about half-way through the month, which we knocked out of the park. The extra $300 to save was a bit tough. We had to cut back on eating out and buy anything that we really didn’t need. But it was worth it! It’s great to see that extra money in our account.

We saved money on our laundry by switching to using DIY foil dryer balls instead of a Bounce sheet.

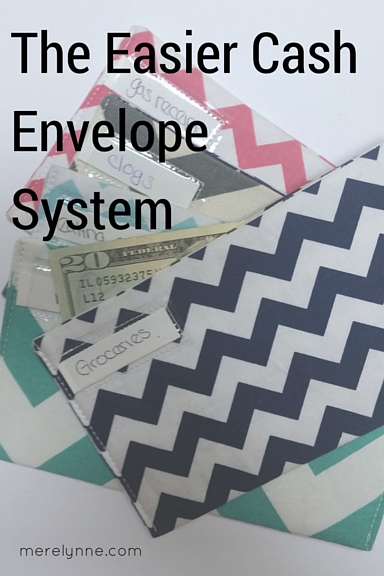

We also re-positioned our money to work better for us by creating an easier to use cash envelope system. I love not carrying cash with us anymore. It’s nice to have a simple debit card lined out for each spending activity. It makes it a lot easier when I’m a the store and I have to say – my wallet is loving not carrying around all that extra weight! Just make sure you’re keeping track of how much you have left in each account. It would not do you any good to overdraft and have an extra fee!

We even talked about some great thrift store and flea market shopping tips that could save you so much money.

How did you do? Did you take control of your money this past month? Money is a great tool to utilize, but you have to make sure you don’t let it control you. It’s easy to do. Easy to spend too much and save too little. So with a little thought and preparation, you can really show it who’s boss.

Latest posts by Meredith Rines, MBA, CFP® (see all)

- How To 10X Your Productivity With This Simple Tool // Using A Red Line Graph - June 24, 2020

- Mini DIY Office Makeover [Photowall Review] - June 17, 2020

- How To Track Your Projects and Profit With Subcontractors - June 11, 2020