Learn what the most commonly missed small business tax deduction is and how you could be losing money each year.

How Price Your Services: The Pricing Formula You Need To Make A Profit

Do you know how to price your services – the right way? Are you tired of overworking yourself just to end up short at the end of the month? I’m sharing my fool proof pricing strategy for service based entrepreneurs. This pricing formula will help you create a system that actually works for your business, which means you’ll be able to cover all of your expenses, not overwork yourself and start making a profit at the end of each month.

Here’s the truth – most small business owners severely undercharge for their services. There a few reasons for this fact – maybe you’re new and you feel as if your expertise doesn’t deserve a higher price (which you’re wrong). Perhaps you are under the mindset that if you have the lowest prices around then you will be swamped with clients and make a ton of money. Again, you’re wrong.

With both of these thought process you might be fully covered with client work, but those clients may not be the best fit for you. These low-end clients may be taking advantage of you, draining you and taking up more time then their agreed-upon price calls for. That means you’re not making any money after you consider your time and your overhead.

You need to set yourself apart from the low end and charge what the market is willing to pay. Now, I am not a believer in charging what you’re worth because you are worth so much. You have to make sure the amount you’re charging is what your clients are willing to pay. That’s why in my video I teach you how to research the perfect pricing for your business to ensure clients will be happy to pay for the value you’re adding.

You can watch the video with my pricing formula online or down below:

Hopefully these tips will teach you how to price your services so you can start to grow your business and start making the money you deserve.

Don’t forget to grab our Bookkeeping Checklist that’s mentioned in the video. This guide will help you know what tasks to do and how often you should be completing them. That way you can trust the numbers you have in your bookkeeping system to give you the right data about your pricing. If you don’t have confidence in your numbers then you will never be able to make the full profit you deserve.

How To Start A Budget (Budgeting Tips For Beginners)

Are you ready to finally start a budget?

So many families go through life living paycheck-to-paycheck, never taking the time to create a budget because they think it’ll be too hard.

Well it’s not. You can create a budget in less than an hour just by following my proven steps.

The best part?

These steps are not hard. They are not complicated. They are direct, to the point and simple. So what are you waiting for? Another bill to come in to send you in a panic?

How about we make a few changes BEFORE that happens so when you get that next unexpected (medical, car repair, appliance repair, or something else) bill, you’re ready.

In today’s video, I’m sharing how to start a budget so that you can FINALLY start conquering your money woes and start making progress towards your goals. You can watch the video online or down below:

Please remember one thing when creating your budget –

Budget mistakes will happen. You will under budget, overspend, over budget and not plan perfectly. It’s okay. It’s all about how you bounce back from financial mishaps that’s the key.

In today’s video we talked about a few steps to creating your budget (which is perfect for you budget beginners that need a few tips on the basics)…

Look at your income and your expenses. Pull up the last three months worth of spending from your bank statements and your credit card statements. Next, pull up the last three month’s worth of income and if you don’t know how to read your pay stub so that you can start planning your income – you’re missing out!

Categorize your expenses and income. Next, you need to grab a few different colored highlighters so that you can quickly categorize your spending. In the video, I mentioned a few different budget categories to consider, but you can always come up with your own that fit you best.

Create your financial goals. You probably know by now that I am a huge fan of financial goals. Having a target can really help keep you motivated and focused when it comes to money management. It’s important you sit down with your spouse to create these money goals, too. That way you both can be on the same page, working together.

Use a zero-based budget. Have you ever heard of a zero-based budget before? If not, they can be amazing tools when learning how to budget. Basically, you want your income to match your expenses each month so that no money is left over. The goal is that if you spend on paper first and assign a job to each dollar then you can make sure to have your money working for you. This part of creating a budget is what usually trips people up so be sure to watch the video where I share what to do when your income isn’t enough to match your expenses.

Tweak and review. Tweak and review. The final step in creating a budget is vital. A budget is not something that you create once and forget about it. You have to constantly review it, constantly tweak it and constantly be willing to make changes when life happens. Some months you will be able to put more money than planned in savings, other months you’ll have a car repair bill that eats away at most of your savings category. It happens. So you need to be prepared. The best way to be ready for what life throws your way? Review your budget on a weekly basis and track your spending each week. That way you can make adjustments as needed to not spend more than your income.

Tips For Your Emergency Fund + 3 Ways To Pay Off Debt

I love talking about emergency funds. Something about them and feeling protected just makes me happy. I’m pretty sure I can trace it back to the day we woke up in the middle of the summer to our refrigerator having gone out in the night. Of course, it all happened right after I had bought groceries and it was miserably hot so my food was going to go bad within hours.

I was furious! Not only was all the money we had just spent wasted, but now we had to go out and spend even MORE money to replace our fridge.

Luckily we had just hit a pretty big milestone – $1,000 in our emergency fund. It had taken us months to get there and it felt so good to have it. Honestly, I thought it was going to last longer than just a few weeks, but that’s how life goes sometimes.

We decided to go appliance shopping and went to a few different stores in our town, but weren’t happy with any of our choices. We really felt they were too expensive for what we were getting and I really didn’t want to drain all of our savings account the first time we needed it. So we decided to make a 2 hour drive to a bigger city to check out a scratch-and-dent store. We ended up finding the perfect fridge (for us) on discount because it had a scratch on the side, which was fine with us because that was the side that was going to be hidden by a wall.

We purchased our new fridge, paid cash and still had money left over in our emergency fund. It was a good day!

Over on my IGTV, I’m sharing how we ended up making our emergency fund successful – it’s all about the location of the account and our solution might surprise you! Plus, I’m spilling details on three different ways you can tackle your debt – debt snowball, highest interest rate first, and one more that could be the answer you need to make progress. Hop on over to IGTV to check it out!

As you can tell making your emergency fund harder to get to is key when it comes to self-control. I love the idea of using a bank across town so that I can still get to it within minutes if I really needed it, but I can’t easily transfer money into my checking.

You should be able to easily setup a portion of your paycheck to go directly into your new bank. Just check with your HR department on adding a second checking or savings account to your direct deposit. The system we use at our office allows me to specify a different bank account and a percentage of each paycheck to deposit. I recommend starting with only 5% at the beginning to make sure you won’t miss it, but slowly increase it until you reach 10% or an amount you’re comfortable with.

If you’re employer doesn’t allow for that then you could easily write yourself a check each month to deposit into your separate savings account.

In the video, I also talked about three different approaches to paying down your debt. Most everyone has heard of the debt snowball technique – starting with your smallest balance and working your way from smallest to largest. A second method is starting with your debt that has the highest interest rate. By knocking that one out first you end up saving more money in the long run because you will end up paying less in interest. The final way we mention was all about using what motivates you the most – picking the one that annoys you the most and just getting it over with. That way you can use that motivation to kick start you and keep you moving forward.

Easy DIY Lip Scrub For Soft, Smooth Lips

A few weeks ago I shared over on my Instagram Stories a go-to beauty product that I’m loving lately. I had so many questions on it, so I thought I would let it live on over on my YouTube channel.

This lip scrub is super easy to create because it uses only 2 ingredients! After using it, my lips feel smooth, moisturized and even a little fuller. WIN!

You can watch the video online or down below to see what to include in this DIY lip scrub:

As you can see, I’m all about saving money and not spending a fortune on beauty products. That’s why if I have a problem I love finding a DIY solution using items I already have on hand.

I hope you enjoy this tutorial as much as I do!

Should You Do A Spending Freeze? (Plus Tips For Doing One The Right Way!)

Curious if your family could benefit from a spending freeze? There are a few questions you should answer:

- Are you struggling with overspending right now?

- Do you wish you had more money in the bank?

- Do you not have $1,000 in your emergency fund today?

If you answered yes to any of these questions then you should consider doing a spending freeze to get you back on track.

A spending freeze is great because it forces you to stop mindlessly spending and actually focus on what your goals are. The best part about spending freezes is that they are completely customizable. You can easily make them for as long or as short to fit your needs. Plus there are some rules you need in place BEFORE starting your spending freeze to help you ease into it nicely and recover from it effectively.

In today’s video I’m sharing if you should do a spending freeze and tips for doing it the right way (with ways to get prepared fast and easily). You can watch the video online or down below:

Resources mentioned in this video:

Why You Should Consider A No Eating Out Challenge

How We Cut $14,000 From Our Budget Last Year

Ready to get your emergency fund fully stocked? Well grab our 6-Month Emergency Fund Savings Plan to help you conquer your rainy day fund once and for all!

How To Cut Your Grocery Bill Right Now (Quick Tips To Save More Money)

One of the easiest ways that you can quickly save money is in your grocery budget. It’s true!

I hear so many complain how their grocery budget is stretched thin, but when we take a closer look at what their buying, where their money is going and how they are meal planning then I can usually help point them into a light bulb moment.

So many families feel as if their grocery buying is almost set in stone. That they can switch brands or they have to buy certain snacks, drinks, and items each week or their family might revolt. While I get to a point because we always have a box of cheez-its on hand for our little man, I also understand how overspending can really deter you from reaching your financial goals.

If you’re willing to overspend a few dollars here and there then eventually those few dollars will start to grow. That means less money towards debt payments, college funds, vacation funds and other sinking funds. That’s why when a reader asked,

“What can I do to really cut my grocery budget without spending hours and hours each month?”

I was ready to answer.

I am assuming by hours and hours she meant coupon clipping and price matching… so that’s what I’m going to go with.

In today’s video I’m sharing my one trick on how you can cut your grocery bill right now and actually spending LESS time each month on groceries. You can watch online or down below:

Let’s recap my grocery hack:

Organize Your List

Make your grocery list in order of your store. You probably know your local store’s layout better than most employees, right? So try to make your list in order of the store’s aisles. That way you can spend less time back tracking, which means you’re more likely to stick to your list and will spend less time in the store.

Start At The Back

When you first go into the store, head straight to the back. That way when you’ve crossed the last item off your list, you’re in front of the checkout. In the video, I mention why this trick is magically when you have little ones ‘helping’ you.

Set The Right Budget

Make sure your grocery budget is set to the right amount. I have a fast rule to help you get started. Having a guideline on how much you should be spending can be really helpful when you’re comparing your grocery budget from month-to-month. Also, make sure you know what’s all included in your grocery budget. When I meet with clients, one of the easiest ways to detect if their budget is off by asking what all they include in the grocery category.

Need more help?

Do you need a little more guidance on setting your family’s budget? If so, grab my Budget Success Checklist. This 9-step guide will help you create a flexible budget for your family.

The Block Schedule (How To Start It To Get More Done)

If you’ve been following me for awhile you know my love of getting stuff done, I talk a lot about being efficient and getting more done in less time a lot on my Instagram. I have a knack to volunteer myself for different organizations in town, say yes more than I should and still have dreams of building my own empire – with work and my business. So I need a schedule that will work for my ever-changing day and my busy life.

That’s why a few years ago I started following the block schedule.

It’s been a game changer. Seriously.

If at the end of the day you feel as if you have accomplished hardly anything on your to do list, you’re exhausted and frustrated then I recommend trying the block schedule. It has seriously upped my efficiency and productivity level by leaps and bounds. It helps you get more done in less time without frustration, without burnout and without exhaustion.

Block scheduling is a pretty simple concept, but it can take a minute to explain because the customization is endless. I put together a quick video for you all about how to get started with the block schedule system, what my blocks look like and how you can adapt them to fit your life.

You can watch my block system online or down below:

Here’s a quick recap:

Think of time as blocks instead of hour-by-hour. We all have a morning block, mid-day block, afternoon, evening, and so on. Now whether you are a stay-at-home mom, work-from-home or work-away-from-home these block schedules can work for you. In the video I share my example with you, which I work outside the home full-time. I also shared an example of a stay-at-home mom, too so you could get a good idea of how to apply it to your schedule.

Every day doesn’t have to be the exact same, but the goal is to create a system that gives you the ability to get it all done in less time. When you’re in your morning block then you aren’t focused on what you could get done in your afternoon block. Instead if something pops into your head that needs to get done later on, you simply write it down in your mom notebook or on a to-do list and get back to your current block.

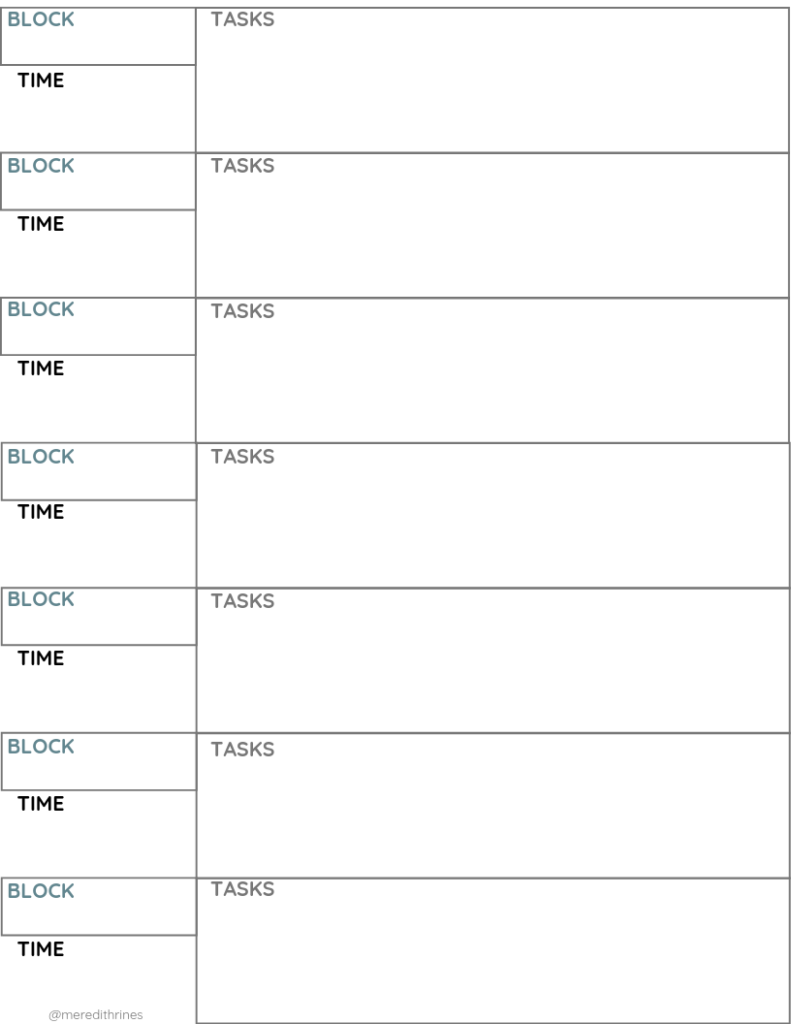

As promised, you can download the template – no signup required! Just click to Download the Block Schedule template and a PDF will open for you.

Download the Block Schedule template.

Need More Help?

If you find your to do list a bit overwhelming and too many tasks on it, then grab our Cross Stress Off Exercise. This quick step-by-step exercise will help you eliminate tasks from your to do list that you can delegate, outsource or don’t even need to mess with. This will help you feel peace when it comes to your day so you can get what matters most done first.

The Easier Cash Envelope Method To Stop Overspending

It’s been a crazy few weeks around here – sickness, tax season, all. the. things. that have seemed to pop up out of nowhere. But that’s life, right?

You can plan, be organized and yet, one thing can turn everything upside down. For us – we’ve all be fighting some sort of bug and have just passed it back-and-forth the past few weeks. It hit hard and has lingered for awhile now. Anytime you’re sick, it just seems to throw everything off. Your housekeeping goes to the wayside (hello dirty dishes in the sink!) and even your budgeting can take a backseat.

Then when you start to feel better and get back into the swing of things, it can be hard to really get back with your finances. Usually money is the last thing families want to mess with – who wants to balance their checkbook, update their budget and track their spending from the past few weeks? No one.

It’s easy when you feel good to stay on top of it all, but once you’re sick then it’s hard to get that traction back. That’s why I wanted to share with you an easier way to handling your budget – I call it the easier cash envelope system. It’s an oldie, but a goodie. It’s one of my most watched YouTube videos of all time and for good reason. I share some great tips on sticking with your budget without the hassle of updating or tracking and without the hassle of going to the bank each week to withdrawal cash.

You can watch the easier cash envelope method video online or down below:

As you can see, this video is all about keeping things easy on yourself. We’ve been using this method for years it makes a huge difference. It’s easy to just login to your bank, transfer money and take care of what you need to take care of. By having separate accounts for your highly active budget categories (think grocers, gas and eating out) then you can transfer your budgeted amount and then forget about it.

Still want to see the big picture?

![]()

Grab our Chief Financial Officer template. This bundle helps you create a flexible budget once and for all. No more stress or worry over every dollar spent. Now, you can keep track of everything in one spot and see how you’re doing overall. I’ve also included our best selling Sinking Funds spreadsheet to help you save for those irregular bills that come only a few times a year. The best part? The Sinking Funds spreadsheet can also be applied to vacations, down payments, and more to help keep you motivated to becoming debt free.

How To Overcome Financial Disappointment (How to Bounce Back From Money Mistakes)

Are you tired of making money mistakes month-after-month? Do you just want to be in a groove when it comes to your finances?

Let’s talk about financial disappointment and making money mistakes.

They happen. It’s part of life, but learning how to bounce back is key in overall financial health.

In today’s video, I’m sharing how to overcome financial disappointment so you can bounce back from those money mistakes. You can watch online or down below:

Here’s a quick recap from the video:

Learn to be proactive instead of reactive.

Do you find yourself recovering from mistakes more often than you would like? Well you might be reactive in your money decisions instead of proactive. To easily change your mindset, you should start to think about the what-ifs and how to better prepare for them.

One of the best tips is to find all the education you can in areas you struggle – listen to podcasts, read blogs, watch videos, do what you can to better yourself. Not everyone thinks of money the same way. When we were paying off over $40,000 in debt we had a lot of experts with varying opinions on how we should save, budget, attack our debt and so on. We read a lot of books, read blog posts and learned as much as we could. The best thing we did is take all of this advice and find the golden nuggets that really clicked with us.

Move Forward.

You need to find a way to move forward after a mistake is made or a mishap occurs. The first thing you need to remember is – DON’T PANIC. When you start to panic that’s when you’ll be more likely to make a mistake that will cost you even more in the long run. Take a step back. Distract yourself. Let yourself think it over before reacting.

Reverse it.

Can you return the item, cancel the contract, stop the order? If you can then that should be your first option. However, that doesn’t always work so you need to make a list of all your available options.

Can you sell it, can you shorten the length of your contract, can you lessen the options for a smaller fee? Make a list and then start to move forward.

Create a plan.

Once you survive a financial mistake or mishap, it’s time to create a plan. This plan needs to be in place to help you recover faster the next time something happens. More than likely the mistake wont’ be the exact same; however, having money in an emergency fund can help you get back on your feet faster. In the video I talk about how you should approach the amount you should have in your emergency savings account.

Need Help?

If you don’t have a funded emergency fund then you should grab my 6-Month Emergency Fund Savings Plan. This guide will help you create a monthly savings goal and find ways to quickly save.