One of the biggest questions I get when it comes to budgeting and getting out of debt is

How do I pay off my credit card when I’m living paycheck-to-paycheck?

Well I’m here to tell you it’s possible. You can do it. You can pay off your credit card even though you’re living paycheck-to-paycheck. It’s going to be hard and you probably won’t like me very much, but the truth hurts sometimes.

You should know that this is what my family has done. J and I have paid off over $10,000 in credit card debt by following these tips. We did it when we first moved when money was tight and we were just getting our feet planted. So I know if my family can do it then your family can do it too. You will just need to be the cheerleader and motivator when things get tought.

Here’s what you can do to get out of credit card debt when money is tight:

Cut back on spending

I know it’s easier said then done, but I’m sure you can find a few areas each week to save some money. Try a spending freeze for a week and you’ll be surprised at the amount of money you can save. You are going to have to get creative to stop spending money. Make sure you’re meal planning with what you already have on hand, stop impulse shopping – yes a fountain diet mountain dew counts as an impulse by even if using change from your car’s floorboard!

Stop using your Credit Card

This one might be a bit hard for you to swallow. But to pay down debt you have to stop incurring debt. You’re probably thinking how you only put gas and groceries on your card each month – just the necessities and you do it to earn points. That’s great! I love points. I let mine accumulate until Christmas and use it on presents – it’s like free money! Here’s the problem with that mentaility – it’s too easy to swipe your card! It’s too easy to assume you have the money to pay for all of those groceries. So stop using it. At least for the next 4-6 weeks because you need to break the mentality and start telling yourself no. Go back to using cash only or use the flexible debit card budgeting trick that my family uses.

Even J and I have to stop using our credit card every few months because the norm becomes just to swipe. It’s too easy to use our credit card instead of looking at our check register and keeping track of our spending.

Update your budget

I am a huge fan of quick and easy budgets. There is no need to make something too complicated for you and your family. All you need is a simple income less expenses type budget. That way you know how much your spending and how much you should be spending on every day items – groceries, gas for your cars, eating out, etc. By spending just a few minutes each day updating your budget you will know how your doing on a day-to-day basis instead of playing a guessing game. You need to be looking at your money on a regular basis, please. One of the easiest ways to not overspend is by having money dates and check-ins. If you realize how close you are to your grocery budget in the middle of the month then you can spend the next few weeks using what you have on hand, making due and getting creative.

Stop eating out

This one may seem like a no brainer to you, but it needs to be said. If you’re struggling to get out of debt then you need to stop eating out so much. Now eating out is easy. It’s quick. And my favorite – no dishes to clean afterwards! However, even running through a fast food place can add up night after night. You need to treat eating out as a date night or special occasion. Save some money and go once every two weeks or once a month. This includes eating out for lunch, too. Don’t try to convince yourself that lunch is cheaper then dinner or how you forgot your lunch and have to eat. Make sure you’re planning ahead for breakfasts, lunches and dinners so you can save yourself the money. Just think if you and your spouse go out to eat twice a week with one child you can easily spend $30-45 after tip. That includes your meal, your spouse’s, a child’s meal and drinks. Now if instead you go out to eat once a month you are saving anywhere from $210-$315 a month! A month!?! That’s crazy! Just think about the dent you could put into your credit card balance by sending an extra $315 a month.

Increase the amount your sending each month

Once you start saving more money by checking your budget, not eating out as much and staying on track with your impulse shopping then you need to start putting that money towards your credit card balance. By sending in more then the minimum payment each month you can seriously cut down the amount of time it will take to pay off your balance. Just think if you could save about $100 a month from doing a week long spending freeze plus $315 from not eating out as much, and by not overspending on groceries anymore you could be putting an additional $500 towards your credit card debt.

So you see it is possible to get out of credit card debt while living paycheck-to-paycheck. It may not always be fun or pretty, but you can do it. You just need to be a little creative with your meal planning, shopping and cautious of where your money is going. I have faith you can do it!

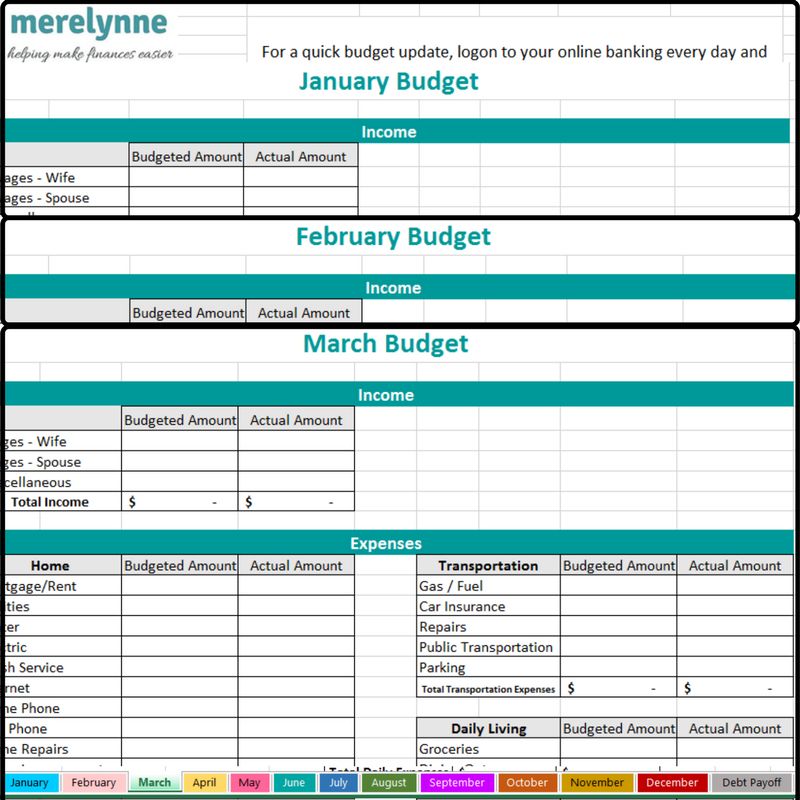

If you’re looking for a great tool to help keep your family on budget, then check out out my budget spreadsheet. Each month is laid out right in front of you where you can keep track of what you budget and what you actually spend. Now you’ll know in real time how you’re doing each month.

Latest posts by Meredith Rines, MBA, CFP® (see all)

- How To 10X Your Productivity With This Simple Tool // Using A Red Line Graph - June 24, 2020

- Mini DIY Office Makeover [Photowall Review] - June 17, 2020

- How To Track Your Projects and Profit With Subcontractors - June 11, 2020