Today is the day, friends! It’s time to get this spending freeze started! On Friday I shared how to do a spending freeze and why in the world I’m willing to commit to not spend any money for the next 7 days.

This past weekend J and I sat down and did a little meal planning to make sure the dinners we were going to have this week used what we already had on hand. I tend to check our pantry, fridge and freezer while meal planning, but this week I checked it before I started making our plan. This way I knew what meats I had on hand, what side dishes were going to be easily made and ingredients I already had. I didn’t want to plan for a dinner then realize I was missing an ingredient or two.

Afterwards we filled our cars with gas and paid any bills that were going to be due this week. I said in my first post last week that any bill or emergency is find to spend money on, but I am trying to plan ahead. For instance our daycare. I work full time and our little guy has to be in daycare. So I went ahead and paid that in advance so I don’t have to worry about it. But I wont’ be doing is hiring any outside babysitter to watch our little man during the evenings. I typically don’t do that anyway, but I just wanted to clarify.

Remember the whole point of a spending freeze is to not spend any money for the next week.

Being prepared is the best step in getting ready for your first spending freeze. Honestly it doesn’t take a lot of prep work, but it’s nice to know you’re ready.

Alright, friends so for the next seven days (that’s a full week!) we will not be spending any money. We won’t be putting gas in our cars (unless it’s an emergency, but we all filled our tanks this weekend), we won’t be going out to eat or spending money on any non-emergencies or non-utilities. Let’s get started!

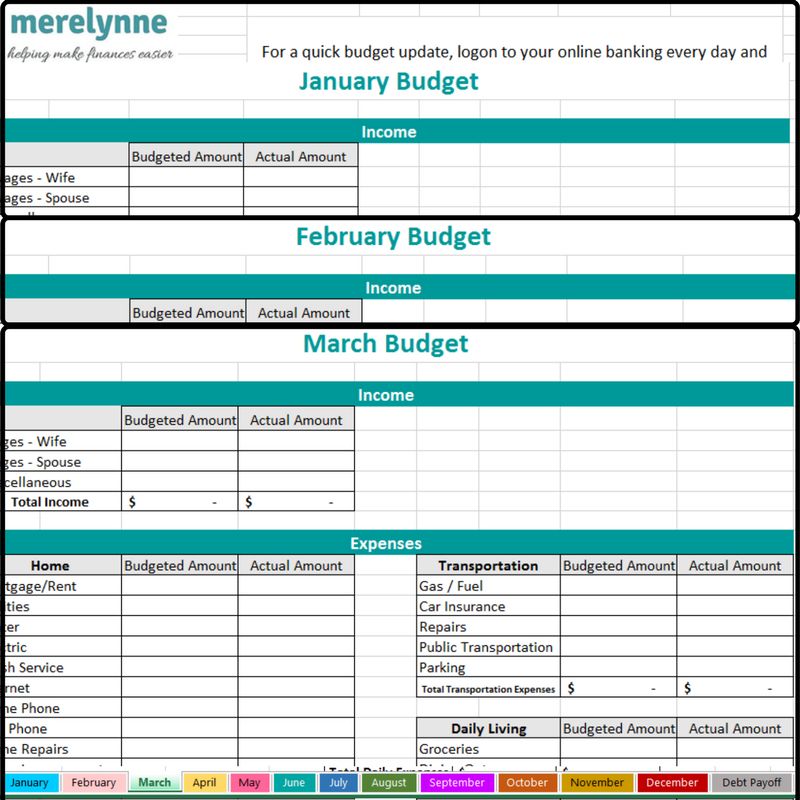

If you’re looking for a great tool to help keep your family on budget, then check out out my budget spreadsheet. Each month is laid out right in front of you where you can keep track of what you budget and what you actually spend. Now you’ll know in real time how you’re doing each month.

Latest posts by Meredith Rines, MBA, CFP® (see all)

- How To 10X Your Productivity With This Simple Tool // Using A Red Line Graph - June 24, 2020

- Mini DIY Office Makeover [Photowall Review] - June 17, 2020

- How To Track Your Projects and Profit With Subcontractors - June 11, 2020