Friends! Welcome today is going to be such a good post. I have been so excited to share this revelation with you for awhile, but I wanted to make sure it was perfect because it’s a lot. It’s going to be a lot to take in and I wanted to make sure I could answer all of your questions. Today I want to share with you how to budget your money and save with three different budgeting techniques you can use to…

Get out of debt

Stop fighting with your spouse

Afford anything you want

Pretty bold statements, but you need a foundation and this is going to help you build it. I promise.

If you want quick and to the point then check out the video below, but I would recommend watching the video and then coming back to read this post. I’m going to go into so much detail and I don’t want you to miss it.

There are three budgeting techniques that I’ve used, that I’ve recommended and that I’ve taught families to follow. Every family is so different and you need to find what is going to work for you. So by learning all three of these budgeting strategies you can now make an informed decision on which one you should be following.

Now before I get started I want to make an assumption – if you can set a bill to auto pay then you already have done it. Most bills like utilities, car payments, credit card payments, insurance, cell phone, etc. can be made automatically each month. You setup a recurring payment and forget about it. So I highly recommend getting those auto drafts setup first before continuing.

I’ll wait…

Got it? Good. Let’s keep going. The first technique is the…

Cash Budget

It is just as it sounds. You spend cash and only cash. Each week or every two weeks you go to the bank withdraw cash for groceries, gas for your cars, eating out and miscellaneous. You spend what you have. Nothing more.

If you run out of cash in your grocery budget then you have two options: 1) put the item back and make do or 2) borrow from one of your other funds.

Now if you choose to borrow from your other funds then you need to make sure you aren’t going to run out of gas on the side of the road one morning. You’re going to have to think ahead and plan so that it’s okay if you take money from another category.

Who should following the cash budget?

Anyone struggling with overspending. Leave your credit card and debit card at home (unless traveling). You only take your wallet with you to spend cash. I purchased this wallet from a shop on Etsy a few years back and it is great. I talk about getting started with cash budget, so feel free to read it.

The Envelope Budget System

The next budget strategy can be combined with cash or with using your debit cards. You keep a running total of what you spent in each category. You can do this on a piece of paper you carry, a check register or an envelope. I prefer the envelope because if I am using a combination of cash and debit card then I can carry my cash with me. I also recommend holding onto your receipts in the envelopes, too.

Here’s how it works:

If you have a family of four then you should be spending roughly $400 a month on groceries (that’s $100 per person per month – no matter if you have a newborn or teenager). If there are 4 weeks in the month then that would be $100 per week on groceries (please note you will have to adjust your weekly budget for those longer months). You divide your envelope into four sections, one for each week. You start with $100 at the top of each section and each purchase gets deducted. You can see more detail in the video above.

Again if you overspend on your groceries then you will have to borrow from another category. You will list that loan or transfer on your envelope. So for instance you have $40 left in your grocery budget this week. What you need will cost about $45. So you decide to borrow from your eating out budget this week. You write down $40 on grocery envelope so your new balance is $0 then you go over to your eating out envelope and subtract $5 from your total. Simple.

Who is the envelope budget system for?

Those of you that have mastered your impulse shopping and can now be trusted to use a debit card or credit card again. If you are savvy with your money and are no longer worried about overspending then you can utilize your credit card to earn reward points.

Bonus Tip: Use your reward points on Christmas shopping!

The final budget technique is the flexible debit card spending.

This system is for those of you that dislike carrying cash around. The ones that are tired of going to the bank, but have self-control over your spending. I’ve detailed what this looks like in another video and a previous post. But here’s the basics:

You have multiple checking accounts – one for groceries, one for gas, one for eating out. Each payday you transfer money into those separate accounts. You use the category specific card when your grocery shopping or dining out. You have to be mindful of the balance because you do not want to overdraft or hear those awful words “Sorry, your card was declined.”

Who is the flexible debit card spending for?

Those of you that have mastered your budget. Those that can really keep up on how much money you have in your accounts and how much money you have left to spend. I created this system a few months ago after waiting for what seemed forever at the local bank. I was tired of waiting in line, tired of sorting cash for the next few weeks and my bank does not have any account fees.

You can combine the flexible debit card spending method with the envelope method. You have separate accounts, but keep track of your spending on the envelope. It can work beautifully!

There you have it – the three budgeting techniques to help you pay down debt and afford anything you want. When you put these practices in place you can start seeing where your money is going. You can start working hard to pay down debt because you’re now sticking with a budget you set for yourself. Now you can start saving for anything you want – on any income. All you have to do is find a budget system that will work for your family and stick with it. I like call new strategies the pilot program and follow them for at least 4-6 weeks. That way you can find out what works and solve any kinks that come up.

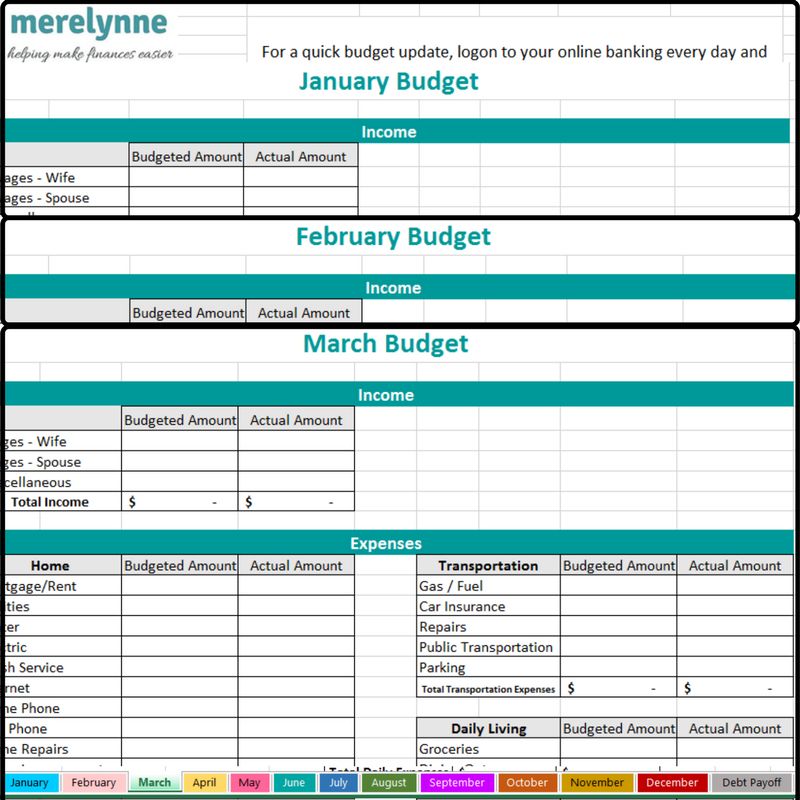

If you’re looking for a great tool to help keep your family on budget, then check out out my budget spreadsheet. Each month is laid out right in front of you where you can keep track of what you budget and what you actually spend. Now you’ll know in real time how you’re doing each month.