The Debt Snowball is a tool to help families and individuals pay down their debt.

The end goal is to be debt free. If you’ve heard of Dave Ramsey then you’ve probably heard of the debt snowball before. I wrote a post on it before, but it’s been a long time. I think it’s time to go over it again.

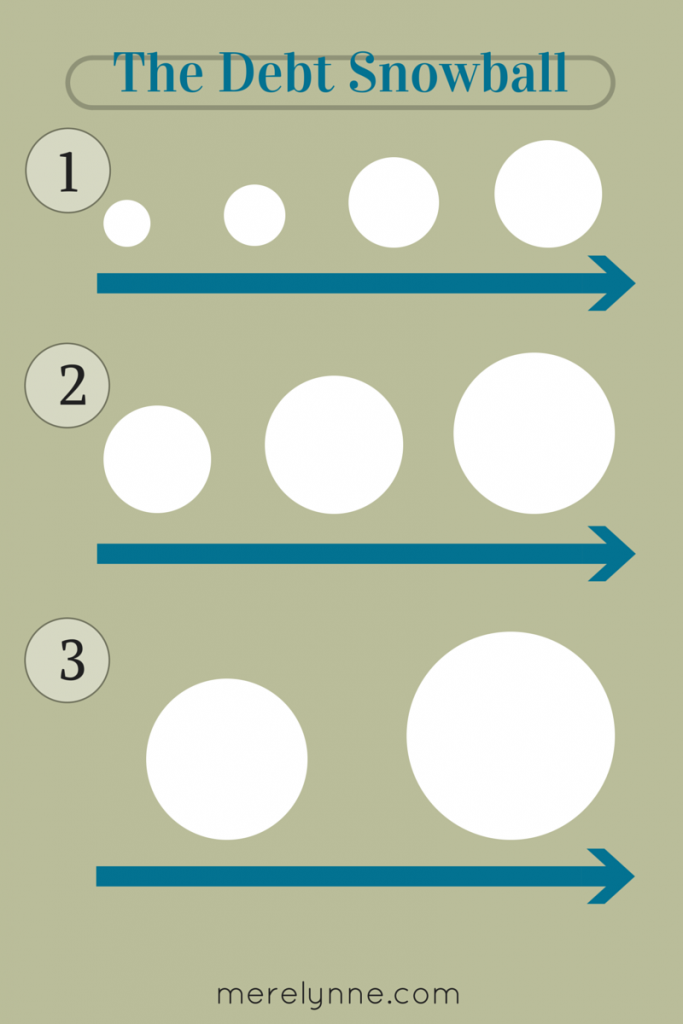

It’s a simple concept. Start with one debt, work your way to paying it off by putting any extra money towards the debt each month. When that debt is paid in full, you take the money you were applying towards it and roll it into another debt. You continue this snowball effect until all bills are paid off.

It’s important to continue paying the minimum payments on your other bills while building your snowball.

It sounds simple, right? But there is much more to it. First you need to decide which bills to pay off. Second you need to decide on an order. Third you need to find extra money each month to allocate towards the bill. Fourth you need to actually put the money towards the bill.

Before you start on your debt snowball it’s important to build your emergency fund. It’s not going to help you if you get hit with an unexpected bill. You will be working hard towards getting out of debt just to put yourself right back in the thick of it.

Let’s start with the first step: knowing which bills to put in the debt snowball.

The snowball effect is open to ANY debt. I mean it. Any debt you have can be paid using this tool.

Here’s a list of what we currently have:

1) credit card

2) personal loan

3) truck loan

4) school loans

5) furniture store credit card

You could also have:

1) loan from a family member

2) health care expenses

3) anything

Next is step two: decide on the order of your bills.

This step is a bit more complicated. You could follow Dave Ramsey’s advice and start with the lowest balance debt first. Then work your way through your debts. I do it a little different. I also take into consideration the interest rate.

Here’s an example: J has a furniture store credit card debt. He got a promotion of 0% interest for the life of the debt as long as he doesn’t miss a payment. Pretty sweet deal, huh? I have a credit card with a little higher balance (less than $2,000). I have an interest rate of 18%. It makes more sense to me to pay down the credit card first. I will be hit with interest charges each month I carry a balance. The furniture store debt has zero interest.

I think it’s best to look at interest rates. If it’s complicated or you just don’t want to think about it. Then follow Dave’s plan. Start with your lowest balance debt and work your way forward.

Step three: find extra money to allocate each month.

You should have created your budget and started using the cash envelope system already. If you are then you should have no problems finding extra money each month. It doesn’t have to be a lot. An extra $50 will make a huge difference.

For instance, your credit card’s minimum payment is $75 each month. You were able to find an extra $75 a month to put towards your bill. Now you’re able to pay $150 per month. Your debt will start to decrease quickly!

The fourth step: actually putting the money towards the bill.

If you make a plan and don’t stick to it then you won’t get out of debt. I like to immediately put the extra money to our debt the moment it hits our account. That way we can’t accidentally spend it on something we don’t need. By having an emergency fund built, if something comes up then we are covered.

Once a bill is paid off, keep that extra money allocated to bills. Don’t relax and start pulling money away.

Let’s use the example above. Your credit card is paid off because you’ve been putting $150 towards each month. Now it’s time to move on to your personal loan. Your monthly payment is $130. Now you take the $130 and add the $150 to it. Now each month you’ll pay $280. Boom! You’ve more than doubled the minimum payment.

These bills will be paid off in no time!

Does the debt snowball actually work? Yes. You have to be dedicated to it. You have to be honest with how much debt you’re in. You have to want to be debt free.

Here’s the workbook I personally use, soon to be debt free. It’s from One Beautiful Home Blog. Yes, I could have created my own workbook, but why? This one is great! It has all the benefits I was looking for. Now I didn’t need all of it. I didn’t print every page. I only printed the paycheck schedule, payment tracker, debt priority list, and enough snowball calculators for each one of our debts.

Dave Ramsey has a pretty nice debt snowball tool on his site. If you need more information, then I suggest checking it out.

Latest posts by Meredith Rines, MBA, CFP® (see all)

- How To 10X Your Productivity With This Simple Tool // Using A Red Line Graph - June 24, 2020

- Mini DIY Office Makeover [Photowall Review] - June 17, 2020

- How To Track Your Projects and Profit With Subcontractors - June 11, 2020

2 thoughts on “Tips on doing the debt snowball”

Comments are closed.