It’s probably no surprise that before J and I get married we are trying to take a good hard look into our finances. I used to say while we were dating (not soon after we started dating because that would have been weird) that I was going to marry his debt and he was going to marry my debt. He used to hate that because he thought that it was a bad thing for his truck payment and little credit card bill, but I would always assure him that it was not bad – it was just the truth. I had several credit card and one big school loan that he was going to say I do to.

Yes, I know that debt incurred prior to marriage is technically separate. His name was nowhere on my school loan and mine was not on his truck loan; however, it is still ours. We are getting married. We are combining incomes, which means that after we are married and the payments we make on our separate debts are now paid with marital income.

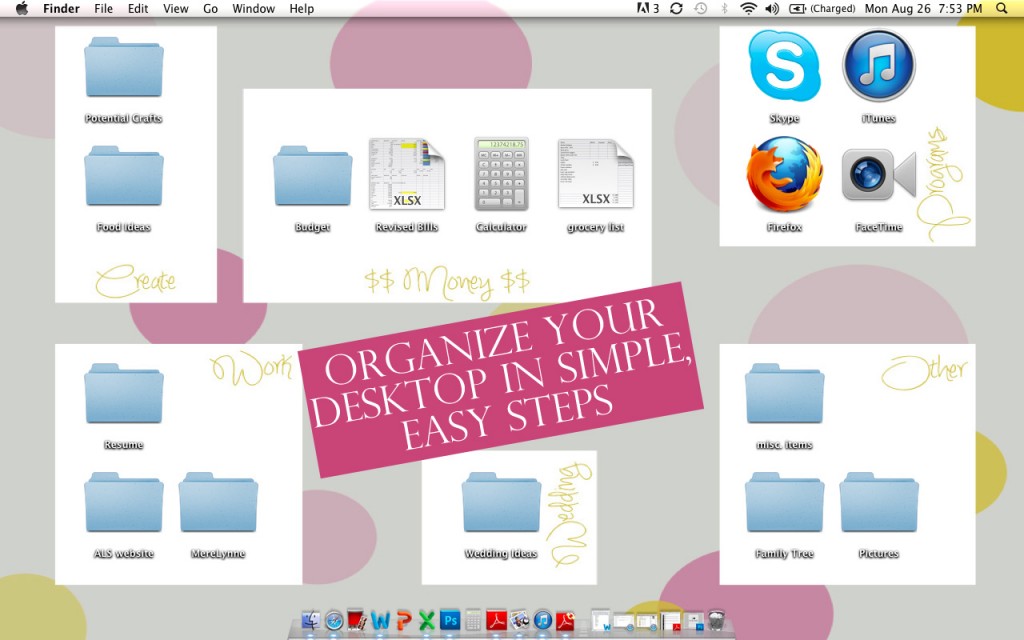

Anyway, back to what this post is suppose to be about. J and I would sit down about once a month and go through our budget, we talked about how to pay our bills and this idea of paying off our debt. My Dad told us about Dave Ramsey and told us not to reinvent the wheel – well, J already knew about it and had read the book; I had heard of Dave Ramsey, but that’s about as much thought as I had given it. So, fast forward and J and I are taking FInancial Peace University together, before we get married.

Honestly, I think it is a genius idea. We keep talking about getting our marriage off to a good start and statistics show that the number one cause of marriage problems is money. So why not agree on the number one problem area before we even tie the knot?

Last week we developed our new budget and I talked about it here. This week we started looking into all of our debt and devised our debt snowball plan. I have to tell you that the idea of combining payments to knock off debt one-by-one is a pretty sweet feeling. We only have 8 separate debts and when we were writing down what the new payment would be on no. 8, it was a satisfying feeling.

I know that we are not there yet and at the rate we are going, meaning if we are unable to put any additional money into our first debt payoff it will take us approximately 18 months to pay it off. Not because it is a high-valued debt but because we are only able to pay so much. But the good news is that we are able to pay on every debt.

This feeling is good and the place we are in is even better. I am excited about our future together as a team. The thought of being debt free and saving for a home is pretty priceless.

Cheers!