A few years back I created a simple weekly savings plan that started in June to help families save a little extra money through out the year. Well that post went viral and it is one of my most re-pinned pins to this day. Obviously I was onto something. Families want to save more money without the stress of actually figuring out HOW to save more money.

For years we struggled with getting a grip on our finances. It took a lot of money dates to get on the same page about our money, which I assume is something most couples struggle with because let’s face it – one is usually the saver and one is usually the spender. You both have big financial goals you want to reach, but money is tight and it’s hard to get on the same page to start making progress.

Trust me when I say this..

You can do it.

It is possible to save money on a tight budget while paying down debt and still having fun. If our family can do it then your family can do it. We are not anymore special than you are, we were just ready for a change and we took a leap of faith.

Watch today’s video online or down below:

Here’s how this weekly savings plan works

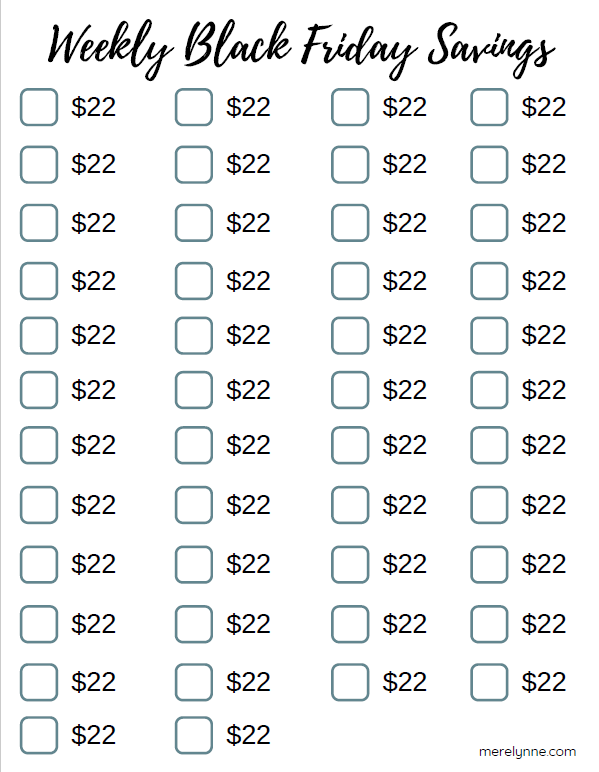

It’s simple. Between now and the week BEFORE Black Friday you will put aside $22 into a savings account. That means for the next 46 weeks you be saving money on a weekly basis. At the end you will end up with $1,012 to use for Christmas gifts, travel or to have in your emergency fund.

Why the week before Black Friday?

Saving money isn’t just about what you keep, but it’s about what you spend. So by saving over $1,000 before Black Friday then you should be able to use that money to buy most of your Christmas gifts while they are on sale for Black Friday and Cyber Monday. I usually make my Christmas Budget and Gift List in early November so I can tackle most, if not all, of my holiday shopping while sitting on the couch with my laptop. I want to encourage you to try to do the same. Have a plan and you’ll be surprised with how much money you can save!

Not sure how you’re going to find $22 a week for this weekly savings plan…

Most families eat out once or twice a week on average, so if you’re struggling to find the extra cash then cut back on how often you eat out or what you pick to splurge on (sometimes McDonald’s drive-thru is just as good as a sit down restaurant and a lot cheaper!). You can even put yourself on an No Eating Out Challenge to help kick start you.

Print out the Weekly Black Friday Savings chart to check off as you progress. Having something visual can help keep you focused.

Download your Weekly Black Friday Savings Checklist.

Weekly Savings Plan Tips:

Save More When Possible: if you find yourself with some extra cash at the end of a week, go ahead and put in your stash. That way if there’s a week later down the road where money is a bit tight you will still be on track to reach your overall goal of having $1,000.

Involve The Whole Family: It’s important to make sure you and your spouse are on the same page with your weekly savings goal. But more than that, involve the kids. Let them check off the progress chart, talk about why you want to save this money, and see if they have any ideas to help find the $22 each week.

For more help in creating a weekly goal, check out my Sinking Funds checklist. This tool can help you create the perfect savings goals to reach all those big financial goals you have.