Are you ready to start using your sinking funds the right way?

Well you’re in luck! I’m walking you through the basics of your sinking funds – how to create them, how to dream big and afford anything you want, and even how to break them down into more manageable goals.

My system is what helped us pay off over $40,000 worth of debt in under three years … while moving across the state (twice!).

I’ve come up with four easy steps that can help you go from “what exactly is a sinking fund?” to “how did we ever live without this!”

Seriously!

Here’s the bottom line – you need to know what to save for, how much to set aside, how to track it (vital!) and when to give yourself the green light to make a withdrawal from your sinking funds.

Earlier this week we talked about how you can organize your sinking funds into a system that works for you.

After I shared my post on Monday I received a few questions on the best way of using your sinking funds and knowing the basics of sinking funds. Now, the first step is creating the right categories for your sinking funds. Once you have those then it’s time to get rolling.

In today’s video I’m want to show you how using your sinking funds can help you afford just about anything you want. You can watch all the tips and tricks online or down below:

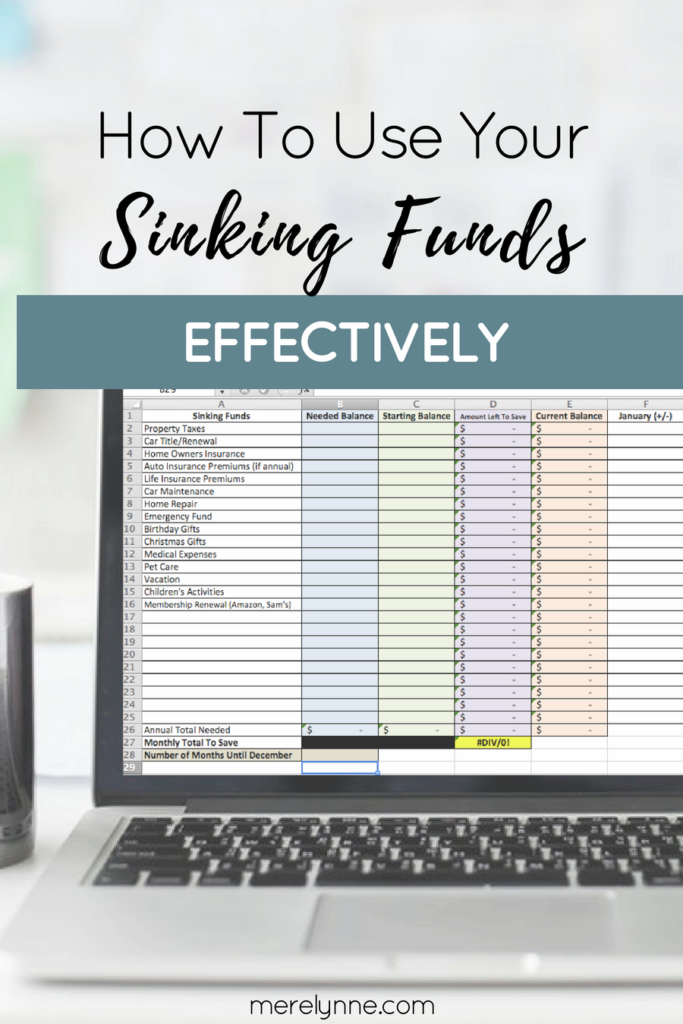

As you can see using your sinking funds is pretty easy and smart. You can truly setup your sinking funds to help you afford anything you want. From the boring, not-so-fun stuff like property taxes and homeowner’s insurance to the more fun things like vacations and becoming debt free.

Make sure you grab your Sinking Funds Checklist that I mentioned in the video. It’s free and can get you started on setting all your funds up the right way.

In the video I also share with you three different options when it comes to tracking your sinking funds (that way you don’t have to go with my tracker if you’re just getting started and want to try it on your own).

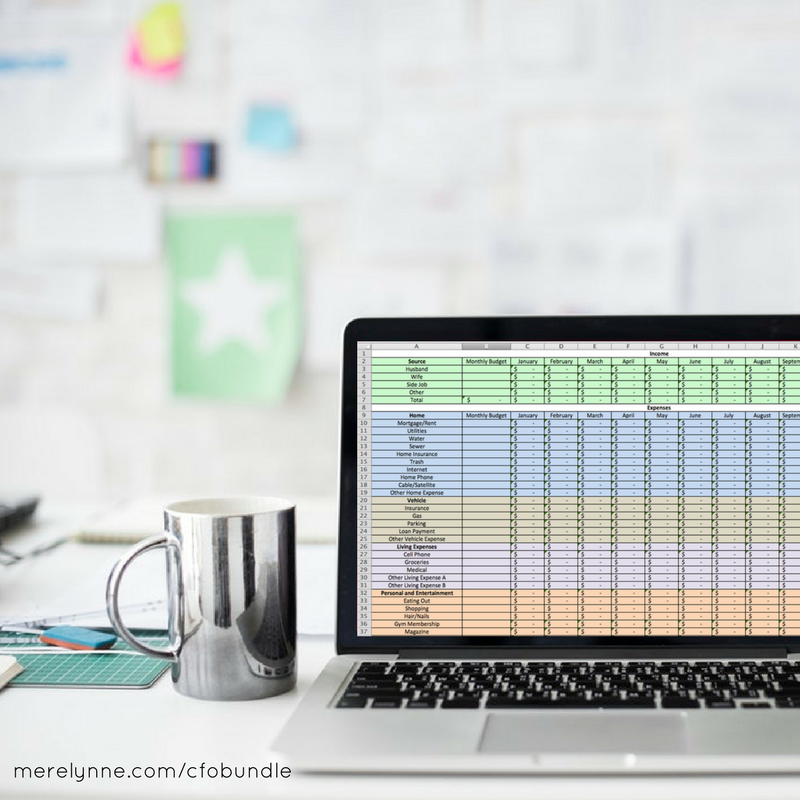

The system that works best for our family is the Sinking Funds Spreadsheet I created. It helps us stay on top of how much money we actually have saved and where it should be allocated to. I know pre-spreadsheet days it was hard to know just by looking at our bank account. Was that recent $100 transfer for vaccinations for our dogs or was it for the recent work we had done on the car?

It’s hard to know. So by having an organizational system to keep up with all the money then we know how we’re doing.

Want to cut out all the extra work?

You can grab your Sinking Funds Spreadsheet over in the shop! Not only does this video help you get started, but you’ll also receive a PDF guide so you can start reaching your financial goals ASAP. Get 25% off by using SINKING at checkout, but the code is only good for a limited time.

Latest posts by Meredith Rines, MBA, CFP® (see all)

- How To 10X Your Productivity With This Simple Tool // Using A Red Line Graph - June 24, 2020

- Mini DIY Office Makeover [Photowall Review] - June 17, 2020

- How To Track Your Projects and Profit With Subcontractors - June 11, 2020