Did you know Christmas is less than 8 months away?!

I know, I know. It’s crazy to start thinking about Christmas already. I mean, how early are stores putting out their decorations now? It may almost be June, but I’m sure we’re going to start seeing decorations soon! HA!

I’m a planner. I think everyone should be planners because it would just help everything run more efficiently. Okay, I’m not that much of a control freak that I think everyone should be just like me. BUT I do think we should plan ahead somewhat.

Every year Christmas sneaks up on me and I’m never ready. I never know what to get at least one person in my family until the week before (if not a few days before). I also never seem to have enough money to go around. I’m frugal by nature. I like using my cash envelope system so I don’t overspend and I love coupons so I can get more bang for my buck. Also, make sure you’re using money saving apps to get rewards points and money back for your purchases. With that being said, I figured this year I would get off on the right foot. Yes, that foot is months early, but it’s never too early to be prepared.

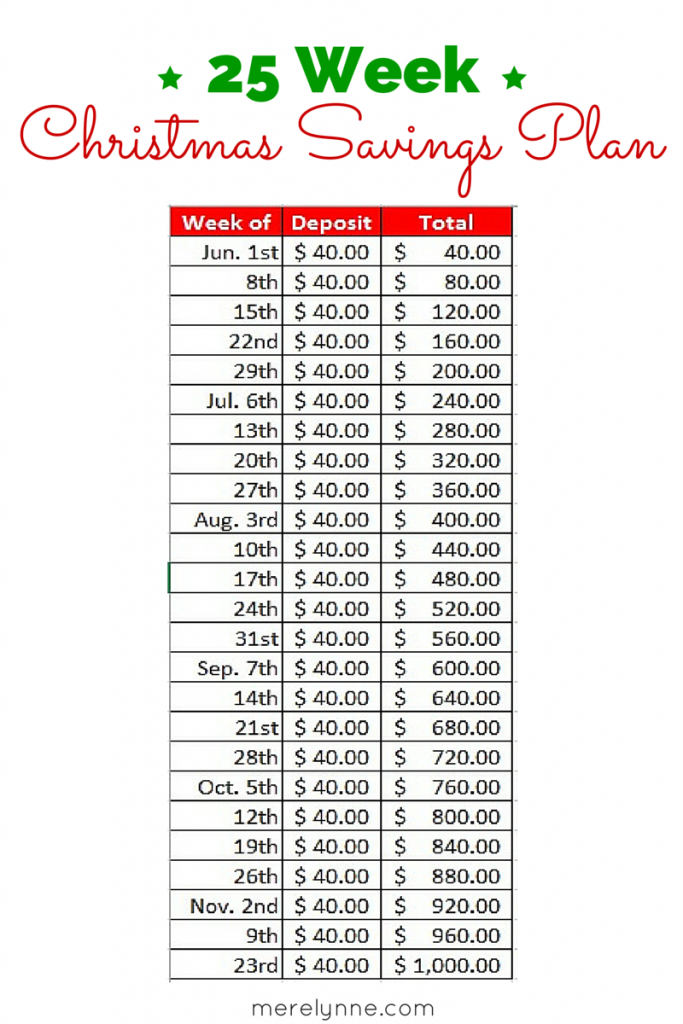

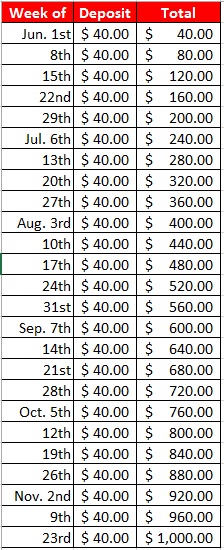

I created a 25 week Christmas savings plan to help keep us on track for the holidays. It’s pretty easy to follow. Starting Monday until the week of Thanksgiving we’re going to put aside $40. That $40 will add up to $1,000. Just in time for Black Friday and Cyber Monday sales! I like to do most of my shopping online on Cyber Monday. Now I will have money saved up and all I have to do is decide what color sweater to get my Mom.

TIP: Print this FREE Christmas savings plan out to check off each week you save. I plan on keeping this bad boy next to me at my desk so I can check off each week I transfer $40 into my savings. I included an image for you to do the same with. Just open it up, print it off and check off when you’re done.

Simple!

Now, if you have a bigger family or like to go all out then just double the weekly amounts to have $2,000 saved.