Budgeting isn’t sexy. It’s not even fun. But it is necessary.

So many people seem to be afraid of budgets. They run from them like it’s chasing them with a knife. But budgets can be your best friend. If that friend is there to help you succeed, hit your goals and retire comfortably.

Yes, budgets can do all that.

Budgets aren’t complicated either. In less than 10 minutes you should have a working budget to go off of. Don’t believe me? Then give yourself 10 minutes and try me.

Here’s my no fail guide on how to create a budget in 10 minutes.

Step One: Gather your bills. I’m assuming you know where your bill information is kept. So, if you can’t find them in less than 10 minutes then that’s not on me.

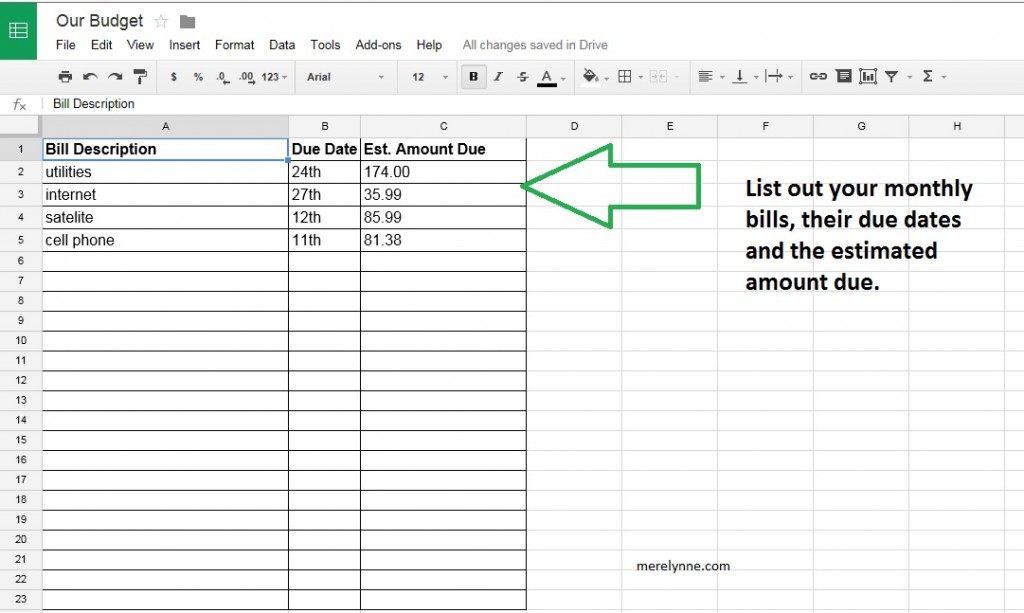

Grab a pen and paper or use Excel. I prefer Google Sheets because you can update it and check it from anywhere.

Step Two: Create a column for monthly bills. Another column marked for due date. A third one for the estimated amount due. Start filling in.

TIP: It’s best to calculate the monthly amount for quarterly or annual bills. That is how much you should be setting aside every month to cover that bill. For instance, you real property tax is $822 due by December 31st. If you are creating your budget in January then you need to take $822 divided by 12 months. You would get $68.50. You should be putting back $68.50 a month.

Now let’s say your tax is still $822 but you’re creating your budget in February. You will take $822 divided by 11 months to get $74.73. You should be putting that amount into a savings account each month.

This tip will help those type of bills from creeping up on you.

Once you have your bills entered in then you can move on to the next step.

This section is for your monthly bills and your debt. So to be sure to list out your credit cards, personal loans, car loans, etc.

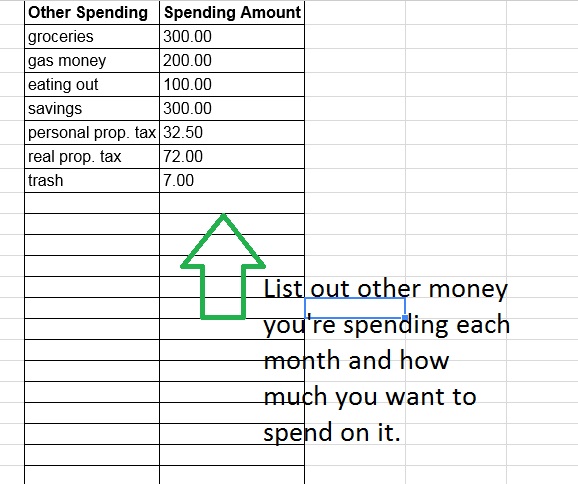

Step Three: Other monthly spending should be accounted for. I’m talking about groceries, gas money, eating out, savings, retirement, etc. The easiest way to see how much you’re spending is by logging into your bank account. You can pull a month’s worth of charges and add them up for each category.

TIP: You need to lower these amounts if you find yourself in the red at the end of every month. If you’re spending $400 a month for groceries for two people then look at reducing it. You’ll have to shop smarter. I recommend keeping your calculator with you while at the store.

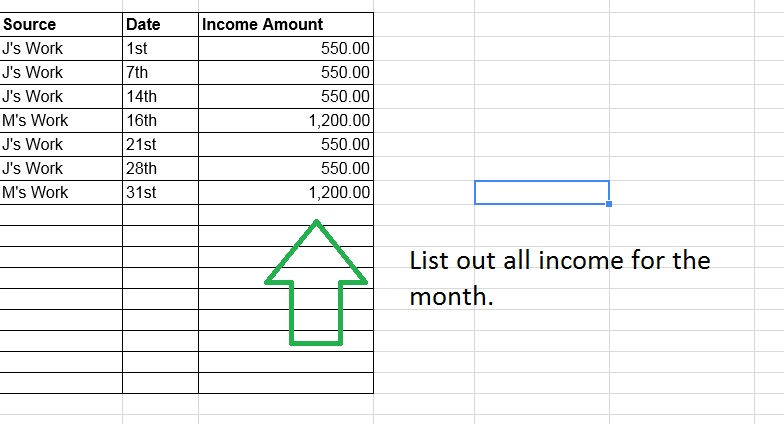

Step Four: Mark your income. You need to know about how much you have coming in every month. Don’t count on bonuses, just put your monthly salary down.

Step Five: Done. You should now be able to see how much you’re spending each month. This will also show how much you’re saving and how much you’re bringing in. If those numbers don’t line up then you need to lower your spending down. Cut in areas that won’t hurt you. Stop eating out as much. Opt for cooking at home. Cut your cable bill by lightening the channel lineup.

Like I said, budgeting is not sexy, but it’s necessary. You should always have an idea of how much you’re spending each month. If not, then you could run into some serious cash flow problems.

Latest posts by Meredith Rines, MBA, CFP® (see all)

- How To 10X Your Productivity With This Simple Tool // Using A Red Line Graph - June 24, 2020

- Mini DIY Office Makeover [Photowall Review] - June 17, 2020

- How To Track Your Projects and Profit With Subcontractors - June 11, 2020

14 thoughts on “How to Create a Budget in 10 Minutes”

Comments are closed.