Let’s face it we always have great intentions to take better control of our spending. We set goals, we work hard and yet, somehow after a few months we let things slip. We get tired of budgeting, we feel overwhelmed and we just give up.

It happens.

But you need to stop the cycle and start making things more simple. It only takes three steps to start to budget consistently. Three. That’s it.

Why do you even want to budget consistently? Well for starters you’ll be able to start saving more money and start paying down your debt faster. Wouldn’t life be easier if you had a little extra money each month or didn’t have to worry about this payment, that payment. Think about what you would do if you had more money in your savings account – all your little expenses wouldn’t be such an emergency.

It would be nice.

In today’s video I’m sharing with you how to budget consistently so that you can actually start saving money. You can watch the video online or down below:

To recap the video, you need to follow these three steps to budget consistently:

THE WHY: Remember why you are wanting to take control of your finances. Are you wanting to provide more for your children, pay off your debt, plan for your future, or something else? Know your why, write it down and remember it.

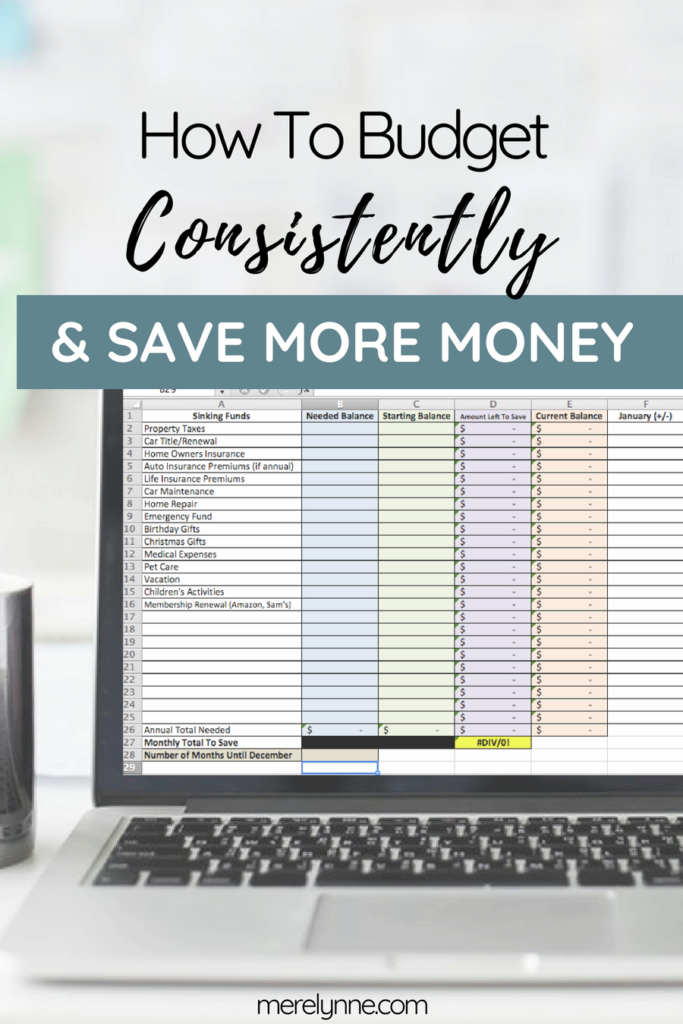

THE HOW: Figure out how you’re going to budget your money. You may want to keep things simple with simply tracking your expenses and income to make sure you don’t go in the red. Perhaps you’re a spreadsheet queen (like me) and want more details to get your hands on. You can use the Chief Financial Officer Bundle to set goals for your spending, track your expenses, and reach your saving targets.

If you’re first getting starting with your budget I recommend just starting to track your spending. The same idea of keeping a food journal to help you lose weight, when you become aware of how much you’re spending then you’re more likely to spend less. Watch my video on the easiest method to track your spending, which only has two requirements: a pen and an envelope.

SET REMINDERS: To get in the habit of budgeting consistently you need to remind yourself to do it. Set weekly reminders in your Google Calendar or on your phone to go off at the same time and same day each week.

Need More Help?

Grab my Budget Success Checklist mentioned in the video. This 9-step guide will help you create the perfect budget for you and your family. It breaks down each step so that you don’t feel overwhelmed, confused or lost. You’re finally be able to create a workable budget that fits your goals.

Latest posts by Meredith Rines, MBA, CFP® (see all)

- How To 10X Your Productivity With This Simple Tool // Using A Red Line Graph - June 24, 2020

- Mini DIY Office Makeover [Photowall Review] - June 17, 2020

- How To Track Your Projects and Profit With Subcontractors - June 11, 2020