We drag our feet when it comes to managing our finances. We pull the shades and hide our eyes because it’s easier that way. We don’t want to worry about budget, spreadsheets and reconciling our bank accounts. It’s like we don’t want to see the reality of it all. We don’t want to face the music that we need to be watching our spending or preparing for the future.

Can you imagine if your employer didn’t keep track of their spending and income? What would happen if you went to deposit your paycheck and it was returned for insufficient funds? You would be livid and frustrated.

Now imagine if you go to the grocery store to buy food for the next few weeks, swipe your card and it’s declined. You would now be embarrassed, flustered and stressed. But all of that is preventable by just spending a little time each month making sure your finances are in order.

Ever wondered how you can conquer all those money woes without breaking a sweat? Well I’ve got something for you today, Momma.

You see about a year ago I introduced my basic budget template to the world. At the time, it was hard and scary because it was the first real thing I created and put out for people to see (I know I budget, but this was something my family was personally using). It was a huge hit! I had so many of you downloading it and using it – I was so happy!

But over time, I realized you might need more. You might need something that is no only simple to use, but also helps you keep track month-after-month. I know for our family I like to see how I do in January compared to February compared to any other month of the year. It’s a nice motivator to keep on track and focused.

That’s when I got to work. I’ve spent the past few months creating, building and tweaking an all new budget template for you. One that is super simple to use, one that keeps track of the entire year in one spreadsheet. It also has a place for your sinking funds, just like the spreadsheet HERE and your debt payoff tracker. It’s the perfect little budget and that’s why I’m calling it the…

Chief Financial Officer bundle.

Why am I calling it that?

Because I want you to become the CFO of your home – no more stressing over money each month. I want you to keep track of how much you’re spending, where you’re spending and when you’re spending. That way you can see a pattern and know how to prepare for those ebbs and flows that come with managing your finances.

Here’s what you’ll be able to do:

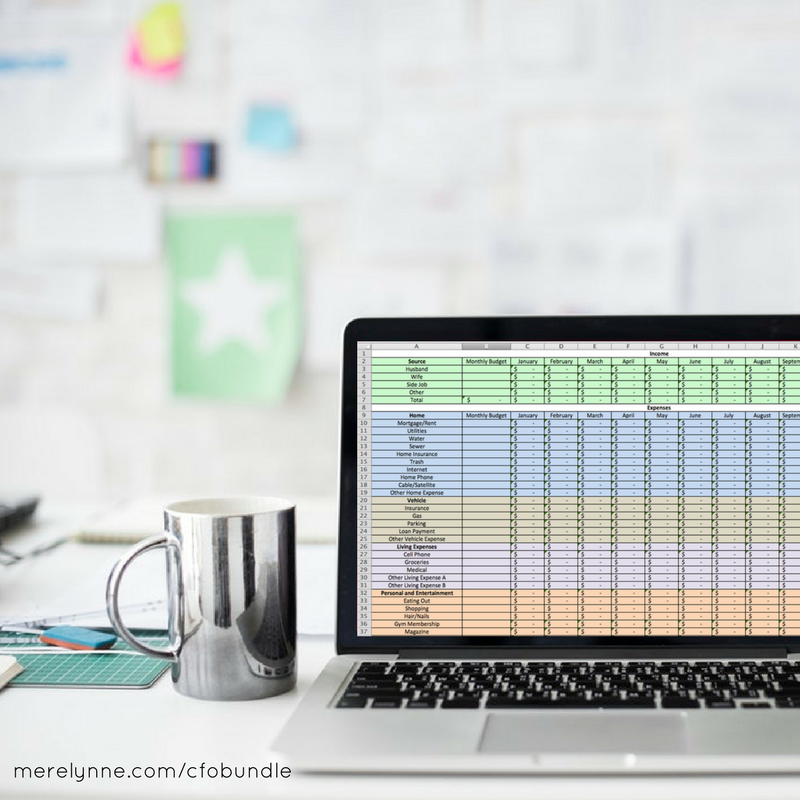

- Track your spending on a monthly basis

- Categorize your spending to see where the majority of your money is going each month

- Compare your budgeted amounts to your actual spending

- Visualize your annual budget all in one screen

- Calculate your sinking funds from one page, for the entire year! See just how much more you need to save enough for your property taxes, your medical bills and even your upcoming vacation

- See all of your family’s finances in one place – no more flipping between screens, papers and bank statements to know how you’re doing

The Excel Budget Spreadsheet will help you calculate your spending in real-time. You can see from month-to-month how well you’re doing – if you’re over or under your projected income and budget. Now you can stop putting off organizing your family’s finances. This one tool can help you take control and stay on top of your money. Now you’ll be able to stop living paycheck-to-paycheck, pay down your debt and live a life you’ve always dreamed of.

Grab your CFO bundle in the shop and if you enter code CFO10 you will get 10% off your purchase. But hurry – the discount is only good through the end of May and then it will go back up.

Latest posts by Meredith Rines, MBA, CFP® (see all)

- How To 10X Your Productivity With This Simple Tool // Using A Red Line Graph - June 24, 2020

- Mini DIY Office Makeover [Photowall Review] - June 17, 2020

- How To Track Your Projects and Profit With Subcontractors - June 11, 2020