Today’s post is all about some budgeting basics – creating your sinking funds.

If you’re new to sinking funds, then just know they are the tool to help you afford anything you want. The gist of sinking funds is that you have a budget category that is usually more expensive than your normal month-to-month ones, and is used only a few times each year. To be successful with sinking funds, you need to create a section in your budget to break these annual (or quarterly) expenses into monthly ones.

Let’s get to an example:

For instance if you have to pay your personal and real property tax every December of about $1200, then you know each month you should be setting aside $100 into a savings account. That way when your tax bill is due, you have the money already saved.

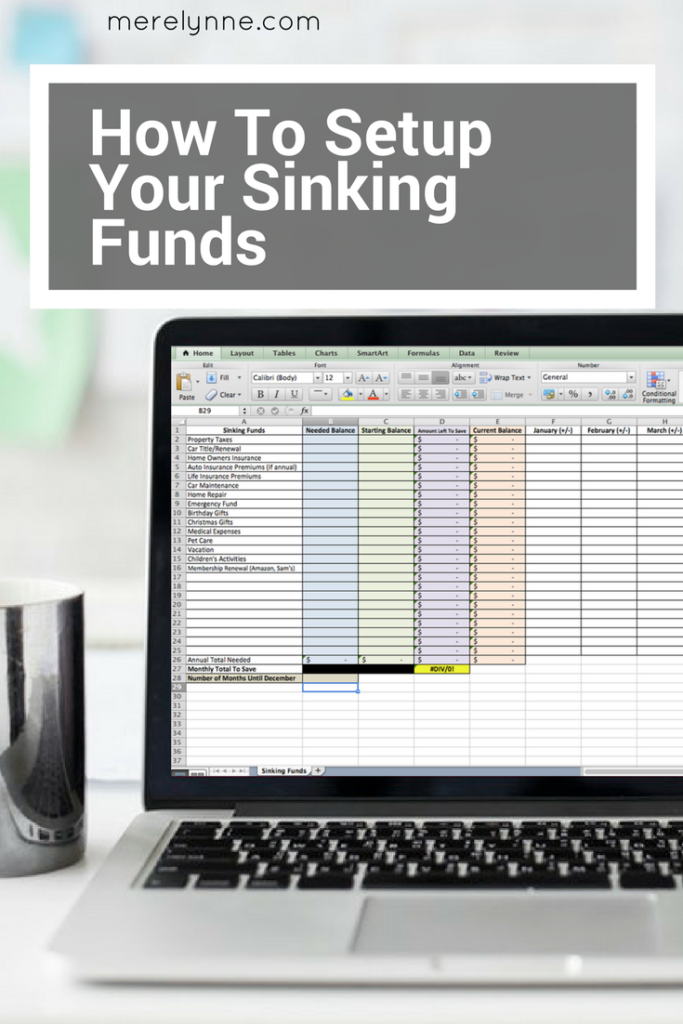

In today’s video I’m going to talk all about creating your sinking funds, how to know which categories you should be saving for, and tips on finding the money in your monthly budget to save. You can watch the video online or down below:

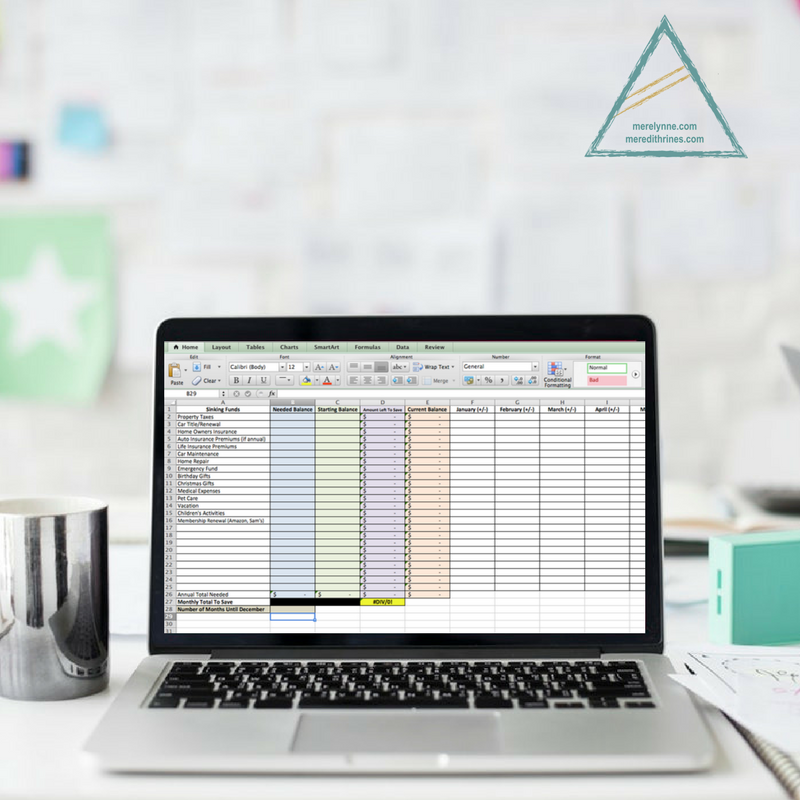

To grab your sinking funds spreadsheet just like the one our family uses, check out the shop.

For more budgeting help, check out these posts:

Creating your budget has never been easier when you use this budget template

Why you should have an emergency fund

Latest posts by Meredith Rines, MBA, CFP® (see all)

- How To 10X Your Productivity With This Simple Tool // Using A Red Line Graph - June 24, 2020

- Mini DIY Office Makeover [Photowall Review] - June 17, 2020

- How To Track Your Projects and Profit With Subcontractors - June 11, 2020

One thought on “Creating Your Sinking Funds”

Comments are closed.