If you’re new around here then you may not have discovered my deep love for budgeting yet. But it’s there, let me assure you.

I’m a stronger believer that you have to budget for the life you dream of and that means buckling down to make some serious money changes. For our family that mean cooking at home more often and watching how much we piled into our grocery cart.

A lot of the changes aren’t hard and require a little bit of prep work – like meal planning, which has had huge benefits for us. Not only are we saving money, but now dinner prep isn’t all on me. If J gets home before me then he can easily see what we’re supposed to have for dinner and get it started. That means most nights dinner is almost finished by the time I pick up our little guy and get home – so nice!

One of the hardest changes has been with the actual budget. I think most of you can agree budgeting is not your favorite thing to do on the weekends. However, I would argue that knowing where your spending your money has been a huge eyeopener for you – it has for us! If I’m being honest, sometimes I forget about going through the McDonald’s drive-thru for that extra snack or to calm down a hangry two year old.

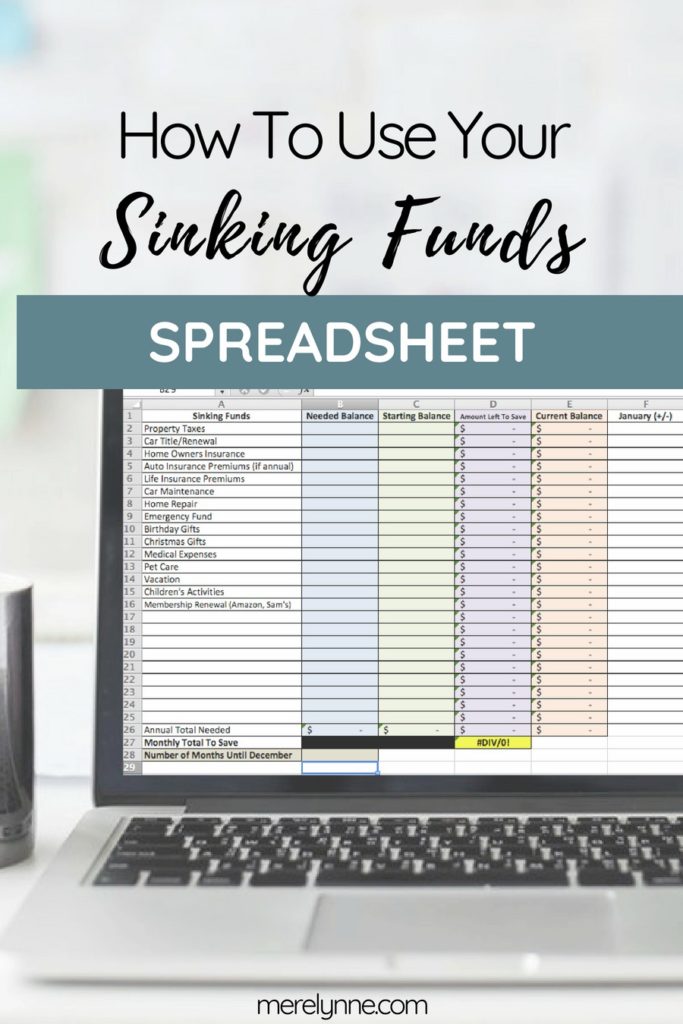

I introduced an update Sinking Funds Template a few months ago and I have received some really great feedback for it (THANK YOU!)! The template has really transformed the daunting task of saving the right amount of money into simply tracking what we’re doing. We open the template, enter how much we spent and where it was at and then the spreadsheet automatically adds up our monthly totals.

We no longer have to go line-by-line to manually add each goal we’re saving for, each time we spent money for something and all the other misc. goals that we struggle keeping straight. This new system makes it a breeze! We can easily open up the template, which I try to do a few times each week, add in any changes and click save.

Today I wanted to share with you an overview of the Sinking Funds Template. I’ve had a great response from when it was introduced a few months ago, but I also have received a few questions, too. I thought I could easily answer the questions I have received and any questions that may not have been asked yet.

The biggest change with this new version is that each goal can have it’s own target date. So if you’re saving for a vacation in June you can also easily save for your property taxes that are due in December. Multiple goals, multiple target dates, and only one monthly savings amount.

Let’s walk through how to use the Sinking Funds Template so you can take control over your money. This spreadsheet is what our family has been using for months now and we’ve noticed a huge shift in our savings (meaning we’re saving more!).

Check out today’s video where I walk you through how to use the CFO Bundle and set it up for you. You can watch online or down below:

See what I mean? Super easy to set it up and personalize it to your family. Plus, the way the monthly tracking is setup it makes keeping up with how much your saving and spending that much easier. You can grab the Sinking Funds Template over in the shop.

Oh and because I love you – I’m offering 25% off the new template for a limited time (and that code might just work for anything in the shop!). Just enter SINKING at checkout. You can grab it for a great deal until end of September.

Want more help?

Check out my Sinking Funds guide, which will help you determine the exact categories you need to be saving for. Plus. I break down the steps you need to know how much to save for all your bills, financial goals and repair categories.

Latest posts by Meredith Rines, MBA, CFP® (see all)

- How To 10X Your Productivity With This Simple Tool // Using A Red Line Graph - June 24, 2020

- Mini DIY Office Makeover [Photowall Review] - June 17, 2020

- How To Track Your Projects and Profit With Subcontractors - June 11, 2020