I shared awhile back how we had been using the cash envelope system for quite some time. We have been following Dave Ramsey after we took Financial Peace University before we were married. We loved the simplicity of it and how only spending cash really helped us stick to our budget. We were paying down debt, had built up our emergency fund and were no longer having to stress about any bills that came our way.

However, I hated. I mean hated having to get cash every few weeks and then having to carry it around with me. Not that we lived in an awful, crime-filled town, but I just didn’t like it. I came up with an easier cash envelope system not too long ago and it has been working beautifully. We switched our cash for debit cards and now have multiple bank accounts to work from.

I would highly recommend anyone wanting to tackle their budget to setup multiple accounts. It really has streamlined the way we run our household and has made everything so much easier.

In your budget you (should) have multiple categories for expense, right? So why not do that with your bank accounts? It makes sense to actually separate out your money just as you do on your budget.

You might be asking yourself….

How do you track multiple bank accounts?

Well, it’s really not that hard and not any different than tracking one. Actually, it makes seeing where your money goes a lot easier. On our budget we have a category for each group of expenses: food, misc. bill paying, emergency fund, tax, etc. Then we have a bank account for each category.

I found that when we had one checking and one savings account it was harder to track our spending. We would have to go back to add up how much we were spending on eating out, how much on gas, how much we were saving, and so on. Now, the charges are separated out.

We track our accounts online. One our banking website there is a master dashboard that we can access each account. So it’s nice to login and see what’s been spent out of each account. So much easier to track then having to dig through our budget and check register each month to add up the totals.

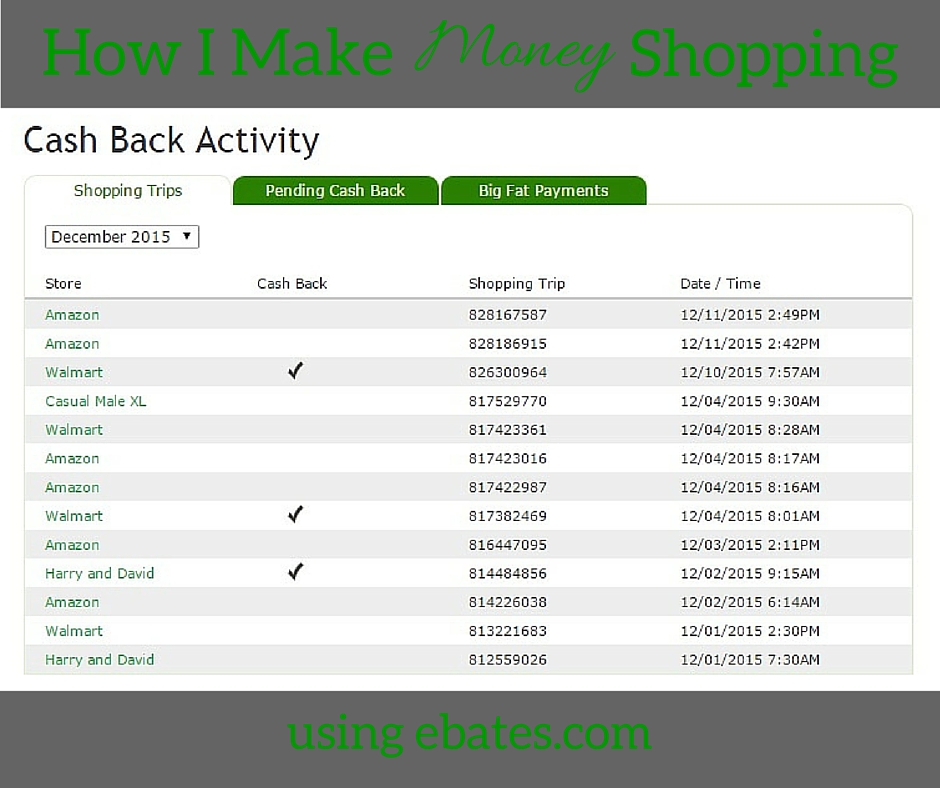

If your accounts are not with the same bank then I recommend using mint.com to track your spending. This free online platform will help track your spending and categorize expenses that are similar. It even has pie charts and graphs to help you visualize how much you’re spending in each category. You can input your debt to track how you are doing on paying off your bills. It’s pretty handy.

Does having multiple accounts hurt my credit?

No. Unless you don’t pay your bills and overdraft your account(s). That will hurt your credit. But if you’re careful with your spending and make sure you never draw out more than you have, then you will be fine.

Does it cost money to open multiple accounts?

If your bank charges you to open multiple checking and/or savings accounts then you need to switch banks. When we opened ours there was one rule – keep a minimum of $100 in your savings account to avoid any penalties. Other than that, we could open as many accounts as we needed. We just know that each savings account has to have a $100 balance at all times. So we deposited $100 and treat that has our new zero balance amount. It’s nice because we also have an extra few hundred dollars that we don’t use or try to tap into.

Here’s the Multiple Bank Accounts Your Family Needs:

Emergency Fund:

Just as it sounds – this savings account is for emergencies only. Not weekend trips out of town or new shoes you saw online, but emergencies. I’ve shared how our emergency fund really helped us when we woke up to a broken fridge one day. If you follow Dave Ramsey, he suggest starting with $1,000 emergency fund. Which is a good number to start with. If your car breaks down then you will have some money to get you going again. If your heater goes out in the middle of winter then you will be able to have the repairman out to fix it and not have to cut into your house payment or grocery money.

J and I like to have enough to cover our deductibles in our emergency fund just in case anything should happen to us. That way if we’ve been in an accident then we will be able to get our insurance going while we figure out what to do.

Once you have most of your debt paid off (everything, but your house) Dave Ramsey suggest bumping your emergency fund up to 3-6 months worth of living expenses. That way if you or your spouse lose their job then you will not have to disrupt your family life while you try to find more work. I’m a firm believer in having 6-12 months of living expenses saved up. Anymore than that then I feel like you’re not having your money work for you. Any extra money should be placed in some sort of interest-bearing account (IRA, money market, retirement plan, etc.) and should be helping you reach your long-term goals.

Tips for building your emergency fund:

Have the money withdrawn automatically from your checking account into your savings account. I recommend having this setup the day your paycheck hits your account so you won’t even miss the money.

If you have a habit of withdrawing money from your emergency fund for non-emergencies then move the account to a separate bank. That way you can’t login to the online portal to transfer money. You have to actually make an effort to do so. There are online bank accounts that give a higher interest rate and when you need to withdraw money it takes a few business days to get to you. Online bank accounts are great if you’re passed the $1,000 emergency fund stage. But when you’re just starting out I would recommend keeping the funds within a car ride of your checking account.

Save at least 15% of each paycheck or more until you reach the $1,000 emergency fund level or your selected amount. Once you have reached the first phase amount then start putting extra money from your paychecks to paying off debt.

Tax Savings

Taxes are apart of life. You can’t really avoid it. This tax savings works for both income taxes that are due in April as well as personal and real property taxes that are due in December. Your state might be a little different on personal and real property taxes, but ours are due by December 31st of each year.

I take our previous year’s amount, add 3% for any increase that might happen then divide by 12 months. So if we pay $1,000 in personal and real property taxes in 2015 then I would add 3% (1000 * 1.03 = 1030) then I would take our new amount of $1,030 divided by 12 (1030 / 12 = 85.83). So each month I put back $85.83 so that by December 31st I will have enough to pay for our county taxes.

For income tax time, the goal is to not owe anything and to not get a refund. That’s the magic formula, but it’s hard to achieve every year. So I like to have a little put back just in case.

I also use this account for our home insurance that’s due in July. I take the amount and divide it by 12 then put that amount into this account to cover that cost, too.

Family Checking

This account is our hub. All of our income comes into this account. Most of our bills are paid directly out of this account. I have our car payments, internet, utilities, car insurance, and any other bill setup to automatically draft out of this account.

This is where your money starts and then is allocated to other checking and savings accounts for the family to use. I make sure that we keep enough to pay all of our bills and then transfer our miscellaneous spending., food budget, savings, etc. to our individual accounts.

Family Checking Tips:

Setup auto-pay when possible to avoid any late payments and penalties.

Setup auto-transfers into your savings accounts to streamline those transactions.

I recommend spending your money on paper first in your budget then start moving money around in the actual accounts. Any money leftover should be kept in this account until the end of the month. Then the extra money should be allocated to savings or any other fund where it’s needed.

You need to keep enough in this account to cover your monthly expenses.

Make sure your bills are paid first before you allocate to any miscellaneous accounts.

Wife’s Checking Account

This is my account – I can spend my money however I want. I pay for any haircuts, girls’ trips, shopping, etc. from this account.

Once our monthly bills and savings are taken care of I allocate money from our family checking account to my checking account. I even have it titled with my name on our banking dashboard so it’s easy to follow. I get to spend this money however I see fit. I can spend it, I can save it, whatever I want. I don’t have to talk it over with J before I purchase something.

When the baby comes, we plan on using my account to cover any non-grocery item costs or daycare costs. Meaning when he gets older, I will cover his haircuts and so on.

This account should not include any family expenses – utility bills, car payments, etc. You can add extra responsibilities to this account, if it fits your family’s needs. Here are a few examples:

- Groceries, if you do all of the grocery shopping then you can add that budgeted expense to the wife’s checking. In our family, I do most of the shopping but not all. So we have a separate account for groceries and eating out.

- Gas for your car. You can add extra funds to cover gas for the month.

Husband’s Checking Account

This one is very similar to the wife’s checking account, but is for J. He can spend this money how he sees fit. As I shared in our easier cash envelope post, J likes to carry his cash with him. So that’s up to him to get. I transfer the amount on payday and then from there it’s on him. I no longer have to worry about it.

Tip for both Wife’s Checking and Husband’s Checking:

Add up any expenses you want to be covered from these accounts. For example, J bowls on a weekly league. So we make sure the amount for each week is going to be covered by his miscellaneous account. That way he is responsible for keeping at least how much he needs for bowling in his account. There is no double dipping in our Family Checking to cover the cost if he didn’t spend wisely.

Grocery Checking Account

This one is simple – it’s our grocery and eating out fund. You can add this amount to your Wife’s Checking account or the Husband’s Checking account, but we found that it didn’t work best for us. I do majority of the grocery shopping for our family, but sometimes J will go for me or will stop to pick up something. So by having a separate checking account then he doesn’t have to cover an expense not in his budget or vice versa.

For awhile I would just let him take my debit card for my checking account, but we found out quickly that it wasn’t going to work. He would spend more than I wanted to and I would be without money for other plans.

Now I transfer our grocery and eating out budget to this account twice a month. We can either spend the money on groceries or spend the money on eating out. Either way it has to last us and provide for our food.

Having a separate grocery checking account just made sense for us. It’s not for everyone and that’s okay.

Optional Accounts:

Slush Fund

Once you have your debt mostly paid off, you have your emergency fund built up to cover 6-12 months of living expenses, and you’re putting money away for retirement then I would recommend a slush fund. This is where you put extra money from each month that your family can spend on whatever you want.

Right now whenever J and I want to take a trip or purchase something big we save for it. It may take us a few weeks or even a few months, but we work as a team to put money aside to get what we want. However, one day we will have a slush fund.

A slush fund could also be call the fun fund. Want to take a weekend trip on a moment’s notice – use the slush fund. Want to head to the water park on a hot day – use the slush fund. Once our little one is here, we might enact a slush fund a little early just so we can do fun stuff together as a family. But trust me, it won’t be costly. I feel that debt should be paid off, savings should be built and you should be putting away for retirement first.

Health Savings Account (HSA)

If you can setup an HSA then I would recommend it. J and I don’t have one and so far, haven’t had a need. My old employer offered a Health Savings Account so I took advantage of it then. But with Obamacare and Insurance changing on a daily basis it’s hard to know keep up with the rules. Make sure you do your research on HSAs before starting anything.

HSAs are great if you have a high-deductible insurance plan. HSAs cover any medical costs that are not covered by your insurance. HSA money is tax-free and can add up for larger families with high-deductible insurance.

DO YOUR RESEARCH ON HEALTH SAVINGS ACCOUNTS THOUGH.

Child Savings Accounts

We don’t have to do this yet, but we will soon enough. Most banks offer a child savings account – our bank calls it a Looney Toons Savings Club. Each bank is different so look on their website or ask a personal banker the details.

I propose opening an individual savings account for each child in your family. It will help teach them how money works and can help teach them to save for something they want. My parents did it for me and I just loved going to the bank with my mom to deposit my savings.

My parents had a weekly allowance that I could earn. I had to complete simple tasks to even qualify for any money – make my bed and straighten my room. Once those were done then I could do extras to earn cash. I could bring in the trash cans from the street, empty the dishwasher, dust, etc. I earned a certain amount for each chore. At the end of the week it was payday. We would add up how much we made, then we put 10% back into savings and 10% into tithing.

About once a month, mom would take us to the bank and let us put our savings into our very own account. I just loved seeing how much money I had and watching it grow – it might be why I work as a financial advisor these days. Money just fascinates me!

That’s the checking and savings accounts I have and would recommend to your family.

Getting your money in order can be super beneficial to you. It can really make budgeting and tracking your money easy. Your goal for your money should be to have it work for you!

Let me know how having multiple bank accounts works for you and if you’ve found anything easier. I love to know!