Choosing to be a stay at home mom or returning to work after baby is a hot topic. I wanted to show why I chose to go back to work after baby. It’s a emotional topic, but one I think is talked about enough.

I work for my family’s accounting and financial planning firm. The reason we moved to my hometown was for me to work with my Dad to learn the ropes. The thought of deciding to quit my job wasn’t possible. I am needed and I love what I do.

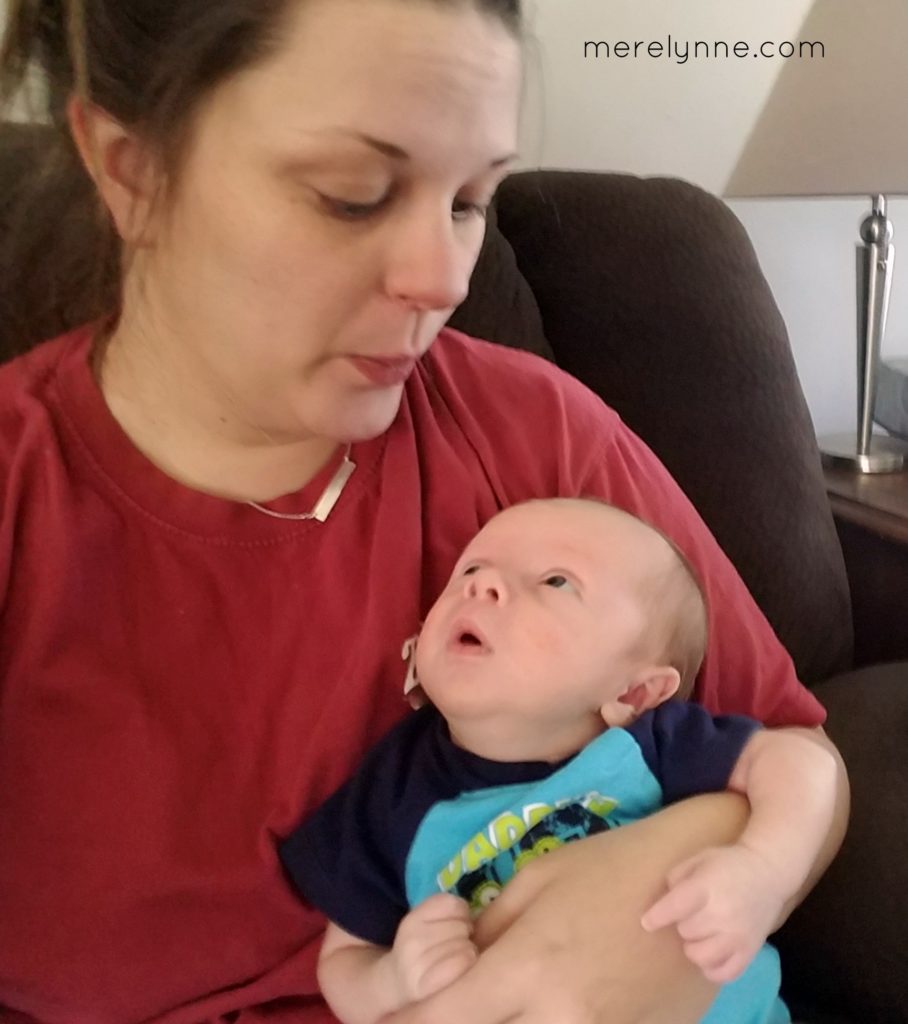

I actually only took a six week maternity leave from work. I probably could have taken longer, but I also knew that I had work to do. Because I work for my family, I was able to bring Baby with me. It was a nice transition for me. I was able to get the balance of getting work done, but was still able to see him across my desk.

Even if I didn’t work my family’s firm, I’m positive I would have returned to work. It’s more than a financial choice, too. Sure the double income is nice, but honestly money isn’t a primary factor.

After four weeks of being home with just Baby and dogs during the day, I found myself irritable with J. I needed that outlet of talking to someone, working on a bigger project and just feeling needed. Don’t get me wrong, every few hours when Baby woke up hungry I felt very much needed, but it’s different.

I loved my time at home and know when he goes into a daycare in a few weeks I will be a complete mess. I will miss being home with my little boy. It’s crazy – I never saw myself as a mother when I was younger, but the moment I heard his cries and saw him for the first time I knew this is why I was put on this Earth. To be his mom.

And one thing that goes along with being a good mom is providing for him. I want to give him the moon.

My parents wanted to give my sister and I more than they were given as kids, and I want to give our son more than I was given. Which is a pretty tall order. I know I want our son to travel (mainly because J and I want to travel!), to accomplish his goals, go to college and not have to worry about the expense of school, and have fun while he’s young. To do all of these things, both J and I need to work.

We need to be saving our money, paying down debt and dreaming of places to travel as a family. With eliminating one of our incomes, we could still accomplish these goals, but we would have to sacrifice a lot right now and it would take longer to get there.

Another reason I went back to work was to save my marriage.

J and I were talking the other night and came to a conclusion. If I wanted to be a stay at home mom then that would probably be the end to our marriage. I know it’s crazy to say that and probably a little hard. But I don’t know how to do that successfully.

I found myself in my short maternity leave depending on J too much. He was my source for socializing, my relief when I needed a break from sleepless nights, and my punching bag when I got frustrated. Not a literal punching bag, but I just became very short with him over the weeks and I know that wasn’t good.

It wasn’t fair to him and deep down I knew that. I like to think that I’m a pretty logical person so I could see myself acting crazy, knew it was too much, but couldn’t stop myself. I realize I was a hormonal mess, but I feel like it was more than that. I needed an outlet and I couldn’t depend on my husband to provide that. I needed to find my own.

Work is my outlet. I get up, get dressed, put on make up and head out the door. I sit at desk and work on projects for our clients. I like answering questions and helping our clients solve their problems. Before having a baby, I really felt my career was what I was supposed to do with my life – crazy, I know!

Now it’s all about finding a balance. A balance between putting J first, providing for our son by giving him the foundation he needs and having a fulfilling career. I will reach that balance at some point and I know I will struggle along the way, but I know I am setting a good example for our son and will be able to do so much with him as he gets older.